Operating Agreement Document for Arizona

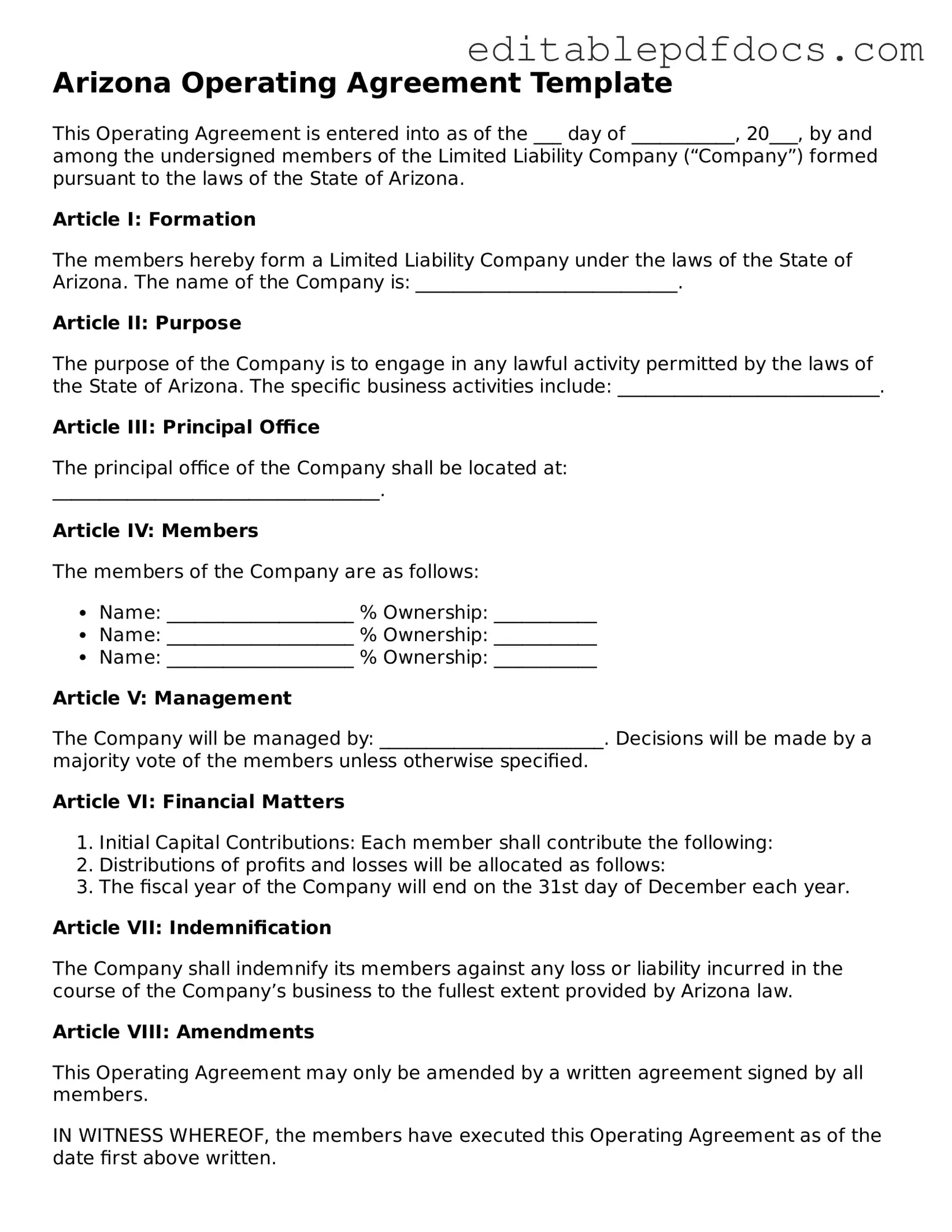

When starting a business in Arizona, particularly a limited liability company (LLC), having a well-drafted Operating Agreement is crucial. This document serves as a foundational guideline for how your LLC will operate, outlining the roles and responsibilities of members, management structure, and procedures for decision-making. It addresses important aspects such as profit distribution, member voting rights, and the process for adding or removing members. Additionally, the Operating Agreement can help prevent disputes by clearly defining each member's contributions and obligations. While Arizona law does not require an Operating Agreement, having one in place offers protection and clarity, ensuring that all members are on the same page regarding the management and operation of the business. In essence, this form not only helps establish a framework for your LLC but also safeguards your interests and those of your fellow members.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC) in Arizona. |

| Governing Law | This agreement is governed by the Arizona Limited Liability Company Act, specifically Arizona Revised Statutes Title 29. |

| Flexibility | LLCs have the flexibility to customize their operating agreement to suit their specific needs, allowing for varied management styles and member contributions. |

| Member Rights | The agreement typically outlines the rights and responsibilities of each member, ensuring clarity in roles and decision-making processes. |

| Dispute Resolution | Many operating agreements include provisions for resolving disputes among members, which can help avoid costly legal battles. |

| Importance of Written Agreement | While not legally required, having a written operating agreement is highly recommended to prevent misunderstandings and provide a clear framework for operations. |

Dos and Don'ts

When filling out the Arizona Operating Agreement form, it's important to approach the task with care. Here are some essential dos and don’ts to keep in mind:

- Do ensure that all members of the LLC are listed correctly, including their names and addresses.

- Do specify the management structure of the LLC, whether it will be member-managed or manager-managed.

- Do clearly outline the roles and responsibilities of each member to avoid confusion later.

- Do include provisions for how profits and losses will be distributed among members.

- Don't leave any sections blank; incomplete forms can lead to legal complications.

- Don't forget to review the document for accuracy and clarity before submitting it.

By following these guidelines, you can help ensure that your Arizona Operating Agreement is completed correctly and serves its intended purpose effectively.

Documents used along the form

When forming a limited liability company (LLC) in Arizona, several documents complement the Arizona Operating Agreement. Each of these forms plays a crucial role in establishing the structure, governance, and operational procedures of the LLC. Understanding these documents can help ensure a smoother formation process and ongoing compliance.

- Articles of Organization: This foundational document is filed with the Arizona Corporation Commission. It officially establishes the LLC and includes essential details such as the company name, address, and the names of the members.

- Member Consent: This document is often used to document the agreement of members regarding the formation of the LLC and the adoption of the Operating Agreement. It serves as a formal acknowledgment of the members' intent to operate the business together.

- Bylaws: While not required for LLCs, bylaws can provide additional governance structure. They outline the rules for managing the company, including procedures for meetings and decision-making processes.

- Initial Capital Contribution Agreement: This document specifies the contributions made by each member to the LLC. It details the amount of money or property each member contributes, which is crucial for determining ownership percentages and profit distribution.

- Membership Certificates: These certificates serve as proof of membership in the LLC. While not mandatory, they can be useful for documenting ownership interests and may be required for certain transactions.

- Affidavit of Correction: This form is utilized to rectify minor errors on official Texas records, such as vehicle titles or property deeds. For more information on filling out this form, please visit https://texasformspdf.com/fillable-affidavit-of-correction-online.

- Operating Procedures: This document outlines the day-to-day operational procedures of the LLC. It can include guidelines on employee roles, financial management, and other operational aspects to ensure clarity among members.

- Tax Election Forms: Depending on the desired tax treatment, members may need to file forms with the IRS to elect how the LLC will be taxed, whether as a sole proprietorship, partnership, or corporation.

- Annual Reports: In Arizona, LLCs must file annual reports to maintain good standing. This document provides updated information about the company and confirms its ongoing compliance with state requirements.

In summary, these documents work together with the Arizona Operating Agreement to create a comprehensive framework for the operation and governance of an LLC. Each form contributes to establishing clear expectations and legal protections for all members involved, fostering a well-organized business environment.

Consider Some Other Operating Agreement Templates for US States

Does California Require an Operating Agreement for an Llc - The Operating Agreement can enhance member accountability and transparency.

How Do I Create an Operating Agreement for My Llc - It can outline how and when members can withdraw from the LLC.

Completing the Chick-fil-A Job Application form accurately is crucial for candidates looking to join the team, and utilizing resources like Fillable Forms can streamline the process by providing clear guidelines and a structured format for submission.

How to Write an Operating Agreement - It can outline procedures for transferring ownership interests.

Operating Agreement Llc Florida - This document helps to prevent misunderstandings by establishing clear expectations.

Similar forms

Partnership Agreement: This document outlines the roles, responsibilities, and profit-sharing arrangements among partners in a business. Like an Operating Agreement, it defines how decisions are made and how disputes are resolved.

-

New York DTF-84 Form: The New York DTF-84 form is essential for accessing state tax records, enabling authorized requests for tax documents. For more information, visit https://nyforms.com/new-york-dtf-84-template.

Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they establish rules for meetings, voting, and the duties of officers, ensuring smooth operations.

Shareholder Agreement: This agreement is designed for corporations and details the rights and obligations of shareholders. It often includes buy-sell provisions, akin to the member rights outlined in an Operating Agreement.

Joint Venture Agreement: When two or more parties collaborate on a project, this agreement defines their contributions and profit-sharing. It serves a similar purpose as an Operating Agreement in outlining roles and responsibilities.

Business Plan: While primarily a strategic document, a business plan includes operational details that can mirror aspects of an Operating Agreement, such as management structure and operational procedures.

Memorandum of Understanding (MOU): An MOU outlines a mutual agreement between parties. Similar to an Operating Agreement, it clarifies expectations and responsibilities, although it is generally less formal.

Employment Agreement: This document details the terms of employment for an individual. Like an Operating Agreement, it specifies roles, responsibilities, and compensation, ensuring clarity in the employer-employee relationship.

Non-Disclosure Agreement (NDA): An NDA protects confidential information between parties. While it serves a different purpose, it shares the goal of establishing clear terms and expectations, similar to an Operating Agreement.

Franchise Agreement: This agreement outlines the rights and obligations of the franchisor and franchisee. It includes operational guidelines that can parallel the governance aspects of an Operating Agreement.

Operating Guidelines: These are internal documents that provide detailed procedures for running a business. They complement an Operating Agreement by offering specific instructions on day-to-day operations.

Common mistakes

When individuals or groups decide to form a limited liability company (LLC) in Arizona, they often encounter the Arizona Operating Agreement form. This document is crucial for outlining the management structure and operational guidelines of the LLC. However, several common mistakes can lead to complications down the line.

One prevalent mistake is failing to specify the management structure of the LLC. Some individuals assume that the default management structure will suffice. In reality, it is essential to clarify whether the company will be member-managed or manager-managed. This decision impacts how decisions are made and who holds authority within the organization. Without this specification, conflicts may arise among members regarding operational control.

Another common error involves neglecting to include all members in the agreement. It is important to list every member and their respective ownership percentages. Omitting a member can lead to disputes and confusion about profit sharing and decision-making authority. In some cases, it may even result in legal challenges if a member claims they were not adequately represented in the agreement.

Additionally, many individuals overlook the importance of detailing the procedures for adding or removing members. Changes in membership can occur for various reasons, such as a member's decision to sell their interest or a new member joining the LLC. Without clear guidelines on how these transitions should occur, the LLC may face difficulties in maintaining its operations and managing member relations.

Lastly, failing to review and update the Operating Agreement regularly is a mistake that can have serious implications. As the business evolves, the needs and roles of its members may change. Regular updates ensure that the agreement remains relevant and reflective of the current state of the LLC. Neglecting this aspect can lead to misunderstandings and disputes that could have been easily avoided.