Motor Vehicle Bill of Sale Document for Arizona

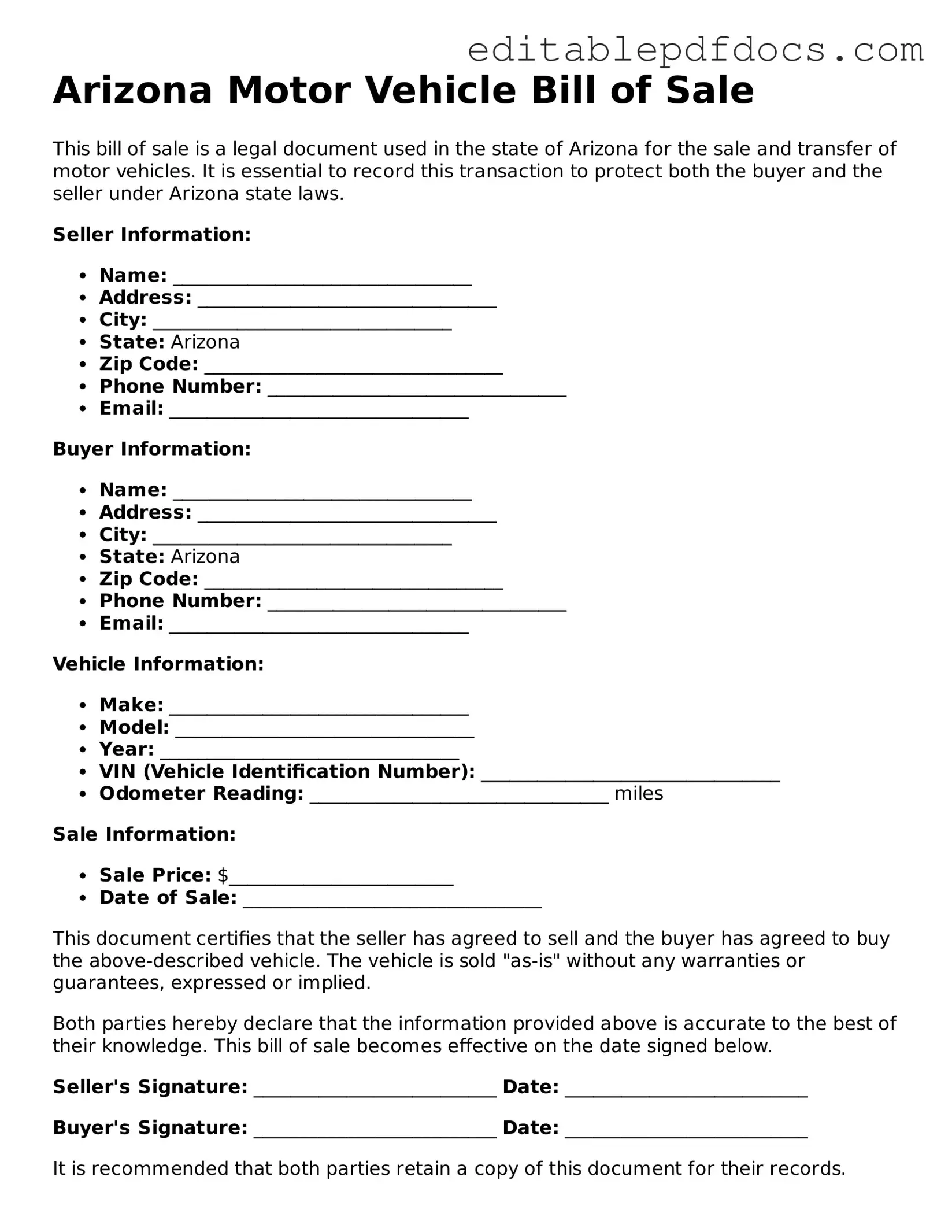

When buying or selling a vehicle in Arizona, a Motor Vehicle Bill of Sale form plays a crucial role in the transaction process. This document serves as a formal record of the sale, detailing important information about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN). It also includes the names and addresses of both the buyer and the seller, ensuring that all parties are clearly identified. The form typically outlines the sale price and may indicate whether the vehicle is being sold "as-is" or with any warranties. Additionally, it is important to note that this document may be required for registration purposes with the Arizona Department of Transportation, making it an essential part of the vehicle transfer process. By having a properly completed Bill of Sale, both the buyer and seller can protect their interests and ensure a smoother transaction, minimizing the potential for disputes down the line.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Motor Vehicle Bill of Sale form is used to document the sale of a motor vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Arizona Revised Statutes, specifically Title 28, which covers transportation and vehicle regulations. |

| Required Information | Essential details include the vehicle's make, model, year, VIN (Vehicle Identification Number), and the sale price. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction. |

| Notarization | While notarization is not mandatory, it is recommended for added legal protection and verification. |

| Transfer of Ownership | The Bill of Sale serves as proof of ownership transfer, which is necessary for the buyer to register the vehicle. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it may be required for future reference. |

| Tax Implications | The sale may have tax implications; buyers should be aware of any applicable sales tax based on the purchase price. |

Dos and Don'ts

When filling out the Arizona Motor Vehicle Bill of Sale form, it is important to ensure accuracy and completeness. Here are some key dos and don'ts to keep in mind:

- Do provide accurate vehicle information, including make, model, year, and VIN.

- Do include the sale price of the vehicle clearly.

- Do ensure both the buyer and seller sign the document.

- Do date the bill of sale to reflect the actual transaction date.

- Do keep a copy of the signed bill of sale for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use white-out or make alterations to the document after signing.

- Don't forget to provide identification information for both parties.

- Don't underestimate the importance of notarization if required.

Following these guidelines will help ensure a smooth transaction and protect both the buyer and seller in the process.

Documents used along the form

When completing a vehicle sale in Arizona, several additional forms and documents may be necessary to ensure a smooth transaction. Each document serves a specific purpose, helping both the buyer and seller to fulfill legal requirements and protect their interests. Below is a list of commonly used forms that accompany the Arizona Motor Vehicle Bill of Sale.

- Arizona Title Transfer Form: This form is essential for transferring ownership of the vehicle. It must be completed and submitted to the Arizona Department of Transportation (ADOT) to officially record the change in ownership.

- Vehicle Registration Application: Buyers must complete this application to register the vehicle in their name. It includes details about the vehicle and the new owner and is necessary for obtaining license plates.

- Emissions Compliance Certificate: Depending on the vehicle's age and the county of residence, an emissions test may be required. This certificate proves that the vehicle meets state emissions standards.

- Employment Verification Form: For verifying employment history, consider using the helpful Employment Verification document template to streamline your verification process.

- Odometer Disclosure Statement: Federal law requires this statement for vehicles less than ten years old. It documents the vehicle's mileage at the time of sale to prevent odometer fraud.

- Proof of Insurance: Buyers must show proof of insurance coverage before registering the vehicle. This document confirms that the vehicle is insured as required by Arizona law.

- Sales Tax Payment Receipt: This receipt indicates that any applicable sales tax has been paid on the vehicle purchase. It may be required for registration purposes.

- Power of Attorney (if applicable): If the seller cannot be present for the transaction, a power of attorney document allows another individual to act on their behalf for the sale and title transfer.

- Vehicle History Report: While not required, this report provides potential buyers with important information about the vehicle's past, including accidents, repairs, and previous ownership.

- Affidavit of Non-Ownership (if applicable): If the seller cannot provide the title due to loss or other reasons, this affidavit can be used to affirm the seller's ownership and facilitate the sale.

Gathering these documents can help streamline the vehicle sale process and ensure compliance with state regulations. It is crucial to have everything in order before finalizing the transaction to avoid any potential issues down the line.

Consider Some Other Motor Vehicle Bill of Sale Templates for US States

What Does a Bill of Sale Look Like - Standardizes the process of vehicle sale agreements across transactions.

What to Put on a Bill of Sale - Promotes accountability in the transfer of vehicles.

When utilizing the FedEx shipping services, it's important to have your documentation in order, and the FedEx Bill of Lading is an integral part of that process. This document not only serves as a receipt for freight services but also acts as a contract between you and the carrier, detailing crucial information regarding the shipment. To assist you in efficiently managing your shipping needs, you can access necessary forms and resources at PDF Documents Hub.

Georgia Trailer Bill of Sale - Can serve as a template for similar future transactions.

Bill of Sale for Car Tennessee - Notarizing the bill of sale may add an additional layer of verification, although it is not always required.

Similar forms

- Vehicle Title: Similar to the Bill of Sale, the vehicle title proves ownership. It includes details about the vehicle and must be signed over to the new owner during the sale.

- Purchase Agreement: This document outlines the terms of the sale, including price and conditions. It serves as a contract between buyer and seller, much like the Bill of Sale.

- Odometer Disclosure Statement: Required by law, this form records the vehicle's mileage at the time of sale. It ensures transparency and prevents odometer fraud, similar to the information provided in a Bill of Sale.

Bill of Sale Form: To ensure proper documentation for your asset transactions, consider the detailed bill of sale form requirements that provide all necessary legal compliance.

- Release of Liability: This document protects the seller by notifying the DMV that they are no longer responsible for the vehicle. It complements the Bill of Sale by confirming the transfer of ownership.

- Vehicle Inspection Report: This report details the vehicle's condition and any repairs needed. It can be included with the Bill of Sale to provide the buyer with assurance about the vehicle's state.

- Sales Tax Receipt: After the sale, buyers often need to pay sales tax. This receipt confirms the tax payment and is relevant when registering the vehicle, much like the Bill of Sale serves as proof of purchase.

Common mistakes

Filling out the Arizona Motor Vehicle Bill of Sale form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not providing complete information about the vehicle. This includes details like the Vehicle Identification Number (VIN), make, model, and year. Omitting any of this information can create confusion and may even cause issues with registration.

Another mistake often made is failing to include the correct date of the sale. The date is crucial for establishing the timeline of ownership and ensuring that the transfer of title is valid. If the date is left blank or inaccurately filled out, it could lead to disputes regarding ownership or liability.

People sometimes overlook the importance of signatures. Both the seller and the buyer must sign the form for it to be legally binding. Neglecting to obtain both signatures can invalidate the sale, leaving both parties in a precarious position.

Additionally, many individuals forget to print their names clearly next to their signatures. While signatures are important, the printed names help clarify who is involved in the transaction. This can be particularly helpful if there are any questions or issues later on.

Not including the sale price is another common oversight. The Bill of Sale should clearly state the amount for which the vehicle is being sold. This is important for tax purposes and for both parties to have a record of the transaction.

Some people also fail to indicate whether the vehicle is being sold "as-is" or if any warranties are being offered. This distinction is crucial, as it protects the seller from future claims related to the vehicle's condition. Buyers should be aware of what they are agreeing to when they purchase a vehicle.

Another mistake involves not keeping a copy of the Bill of Sale for personal records. After the sale is complete, both parties should retain a copy of the document. This serves as proof of the transaction and can be important for future reference, especially if any disputes arise.

Inaccurate odometer readings can also pose a problem. The form requires the seller to provide the current odometer reading at the time of sale. Failing to do so, or providing an incorrect reading, can lead to legal issues regarding mileage discrepancies.

Some individuals might not realize the importance of checking local regulations. While the Bill of Sale is a standard document, there may be specific requirements or additional forms needed in certain counties or cities within Arizona. Ignoring these local regulations can complicate the sale.

Finally, many people underestimate the importance of reviewing the completed form before submitting it. Taking a moment to double-check all the information can prevent many of the errors mentioned above. A thorough review can save time and potential headaches later on.