Last Will and Testament Document for Arizona

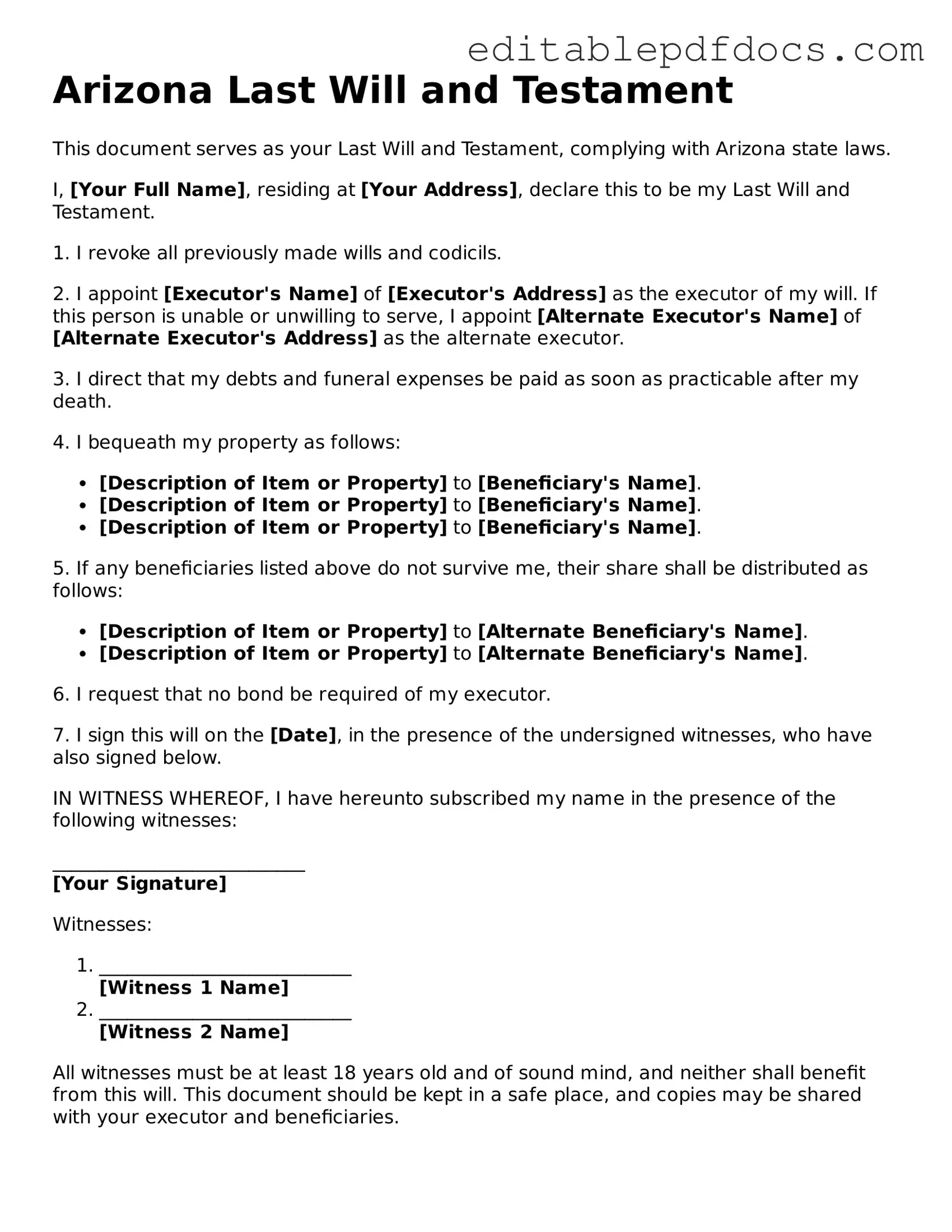

Creating a Last Will and Testament is a vital step in ensuring that your wishes are honored after your passing. In Arizona, this legal document serves to outline how your assets will be distributed, appoint guardians for minor children, and designate an executor to manage your estate. The Arizona Last Will and Testament form is structured to facilitate these processes clearly and effectively. It includes essential components such as the testator's identification, a declaration that the document is a last will, and detailed instructions regarding asset distribution. Additionally, the form requires signatures from witnesses to validate the document, ensuring that it meets state legal requirements. Understanding the key elements of this form can help individuals navigate the complexities of estate planning, providing peace of mind that their intentions will be respected and carried out. By utilizing the Arizona Last Will and Testament form, individuals can take proactive steps to secure their legacy and protect their loved ones in the future.

File Information

| Fact Name | Description |

|---|---|

| Legal Requirement | In Arizona, a Last Will and Testament must be in writing and signed by the testator, who must be at least 18 years old. |

| Witnesses | The will must be signed by at least two witnesses who are present at the same time. These witnesses should not be beneficiaries of the will to avoid potential conflicts. |

| Revocation | An Arizona will can be revoked by a subsequent will, by a physical act (such as tearing or burning), or by a written declaration that clearly states the intent to revoke. |

| Holographic Wills | Arizona recognizes holographic wills, which are handwritten and signed by the testator. However, they must clearly express the testator's intent and be dated. |

| Governing Law | The governing law for wills in Arizona is found in Title 14 of the Arizona Revised Statutes, specifically under sections related to wills and estates. |

Dos and Don'ts

When preparing an Arizona Last Will and Testament, it is crucial to follow certain guidelines to ensure that your wishes are honored and that the document is legally valid. Here are nine important dos and don’ts to consider:

- Do clearly identify yourself in the will. Include your full name and address to avoid any confusion.

- Do specify how you want your assets distributed. Be as detailed as possible to prevent disputes among beneficiaries.

- Do appoint a personal representative. This individual will be responsible for carrying out the terms of your will.

- Do sign the will in the presence of at least two witnesses. Arizona law requires this for the document to be valid.

- Do keep the original will in a safe place. Make sure your personal representative knows where to find it.

- Don't use vague language. Ambiguities can lead to misunderstandings and legal challenges.

- Don't forget to update your will after major life events. Changes such as marriage, divorce, or the birth of a child may necessitate revisions.

- Don't include funeral instructions in your will. It’s better to communicate these wishes separately to avoid delays in the probate process.

- Don't attempt to write your will without understanding the legal requirements. Consider consulting an attorney to ensure compliance with Arizona laws.

Documents used along the form

When creating a Last Will and Testament in Arizona, there are several other important documents that may be used to ensure that your wishes are fully expressed and legally recognized. These documents can help clarify your intentions regarding your estate and provide guidance to your loved ones. Below are some commonly used forms and documents that often accompany a will.

- Durable Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become unable to do so. It remains effective even if you become incapacitated.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document designates an individual to make medical decisions for you if you are unable to communicate your wishes due to illness or injury.

- Living Will: A living will outlines your preferences regarding medical treatment and end-of-life care. It provides guidance to your healthcare providers and loved ones about your wishes in situations where you cannot express them.

- Florida Marriage Application Form: For couples in Florida, this form is essential for obtaining a marriage license within 60 days of their wedding date. You must provide personal information for legal purposes, making it crucial to view the form before proceeding.

- Revocable Living Trust: This legal arrangement allows you to place your assets into a trust during your lifetime. It can help avoid probate and ensure that your assets are distributed according to your wishes after your death.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. These designations can override instructions in your will, so it’s important to keep them updated.

By considering these additional documents, you can create a comprehensive plan that addresses various aspects of your estate and healthcare decisions. This not only provides peace of mind but also helps your loved ones navigate difficult situations with clarity and guidance.

Consider Some Other Last Will and Testament Templates for US States

Last Will and Testament Washington State - A legal safeguard against potential claims on your estate by individuals not included in your plan.

As a vital part of the application process for Disability Insurance benefits in California, the EDD DE 2501 form requires careful attention to detail. To ensure accuracy and compliance, utilizing resources such as Fillable Forms can greatly facilitate the completion of this important document, helping applicants receive the support they need in a timely manner.

How to Create a Will in California - A safeguard to ensure that specific items go to chosen beneficiaries.

Florida Will Requirements - Incorporates personal anecdotes or wishes that may not be covered by the legal aspects of the will.

Similar forms

- Living Will: A living will outlines an individual's preferences regarding medical treatment in situations where they may no longer be able to communicate their wishes. Like a Last Will and Testament, it serves to express personal decisions but focuses on healthcare rather than the distribution of property.

- Durable Power of Attorney: This document allows an individual to designate someone to make financial or legal decisions on their behalf if they become incapacitated. Similar to a Last Will and Testament, it involves the delegation of authority but is activated during the individual’s lifetime rather than after death.

- Healthcare Proxy: A healthcare proxy appoints someone to make medical decisions for an individual when they are unable to do so themselves. It shares the same intent of ensuring personal wishes are respected, akin to how a Last Will ensures that one's estate is handled according to their desires.

- Trust: A trust is a legal arrangement where one party holds property for the benefit of another. Like a Last Will, it can dictate how assets are distributed after death, but it can also be used to manage assets during a person's lifetime.

- Codicil: A codicil is an amendment to an existing will, allowing for updates or changes to be made without creating an entirely new document. It is directly related to the Last Will and Testament, providing a means to modify the original intentions expressed in the will.

- Letter of Instruction: This informal document provides guidance to loved ones about personal wishes, funeral arrangements, and other important matters. While it is not legally binding like a Last Will, it complements the will by offering additional context and information.

- Transfer-on-Death Deed: To simplify the transfer of property after your passing, consider the comprehensive Transfer-on-Death Deed form options that facilitate a swift and uncomplicated process for your beneficiaries.

- Prenuptial Agreement: A prenuptial agreement outlines the distribution of assets and financial responsibilities in the event of a divorce. While it is focused on marriage, it shares the commonality of asset management with a Last Will and Testament.

- Joint Tenancy Agreement: This agreement allows two or more individuals to hold property together, with rights of survivorship. Like a Last Will, it addresses the transfer of property upon death, although it operates outside of probate.

- Beneficiary Designation: This document allows individuals to name beneficiaries for certain assets, such as life insurance policies or retirement accounts. Similar to a Last Will, it specifies how assets are to be distributed upon death, often bypassing the probate process.

Common mistakes

When filling out the Arizona Last Will and Testament form, individuals often make several common mistakes that can lead to complications later on. One of the most frequent errors is failing to properly identify the beneficiaries. It's crucial to include full names and, if possible, addresses of all beneficiaries. This clarity helps avoid confusion and ensures that the assets are distributed as intended.

Another mistake is neglecting to sign the will in the presence of witnesses. In Arizona, a valid will requires the signatures of at least two witnesses who are not beneficiaries. Without these signatures, the will may be deemed invalid, leaving your wishes unfulfilled.

People also sometimes forget to update their wills after significant life events. Changes such as marriage, divorce, or the birth of a child can affect how you want your assets distributed. Regularly reviewing and updating your will ensures that it reflects your current wishes and circumstances.

Additionally, some individuals may not clearly specify how they want their debts and taxes to be paid. This oversight can create confusion and disputes among beneficiaries. Clearly outlining these details can help streamline the process and prevent potential conflicts.

Finally, a common mistake is using vague language or failing to provide specific instructions regarding personal property. Items like family heirlooms or sentimental possessions should be clearly described to avoid misunderstandings. Being specific about your wishes can make the distribution process smoother for your loved ones.