Deed Document for Arizona

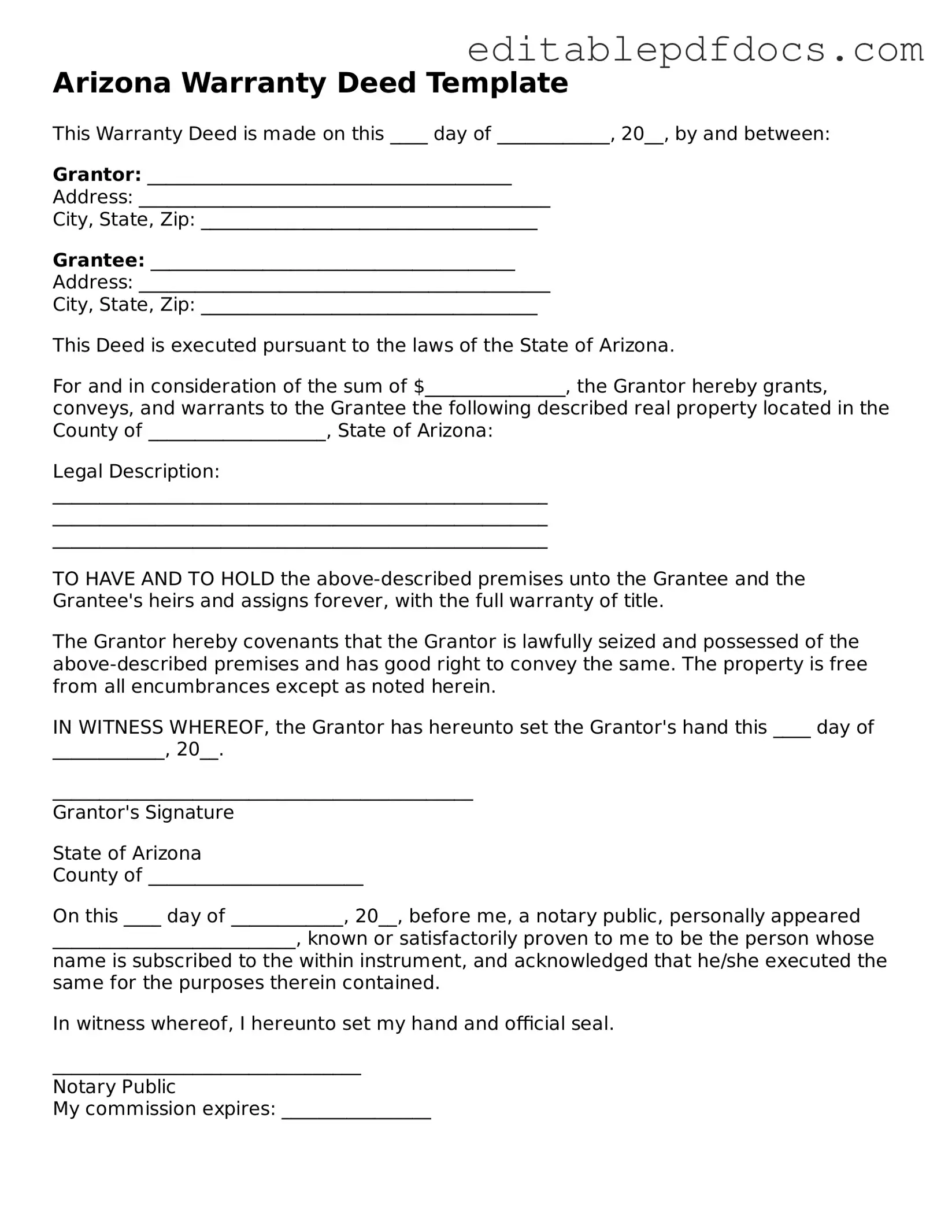

When navigating the complexities of property ownership in Arizona, understanding the Arizona Deed form is essential. This document serves as a crucial tool for transferring real estate from one party to another, ensuring that ownership rights are clearly defined and legally recognized. The form typically includes vital information such as the names of the parties involved, a detailed description of the property being transferred, and the signature of the grantor, which is the individual or entity conveying the property. Additionally, the Arizona Deed form may require notarization to validate the transaction, providing an extra layer of security and authenticity. Whether you are buying, selling, or gifting property, knowing the nuances of this form can help streamline the process and protect your interests. Understanding the different types of deeds available, such as warranty deeds and quitclaim deeds, also enhances your ability to make informed decisions. By familiarizing yourself with the Arizona Deed form, you empower yourself to engage confidently in real estate transactions, ensuring that your rights and responsibilities are clearly articulated and upheld.

File Information

| Fact Name | Description |

|---|---|

| Governing Law | The Arizona Deed form is governed by Arizona Revised Statutes, Title 33, Chapter 2. |

| Types of Deeds | Arizona recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Recording Requirement | To be effective against third parties, a deed must be recorded with the county recorder's office in the county where the property is located. |

| Signature Requirement | All parties involved in the transaction must sign the deed for it to be valid. |

| Notarization | A deed must be notarized to ensure its authenticity and to facilitate recording. |

| Property Description | The deed must include a clear and accurate description of the property being transferred. |

Dos and Don'ts

When filling out the Arizona Deed form, it’s important to follow certain guidelines to ensure the document is completed correctly. Here are some things you should and shouldn’t do:

- Do double-check all names and addresses for accuracy.

- Do ensure that the legal description of the property is complete and precise.

- Do sign the deed in front of a notary public.

- Do keep a copy of the completed deed for your records.

- Don’t leave any required fields blank.

- Don’t use white-out or any correction fluid on the form.

- Don’t forget to include the date of the transfer.

- Don’t submit the deed without verifying that all signatures are present.

Documents used along the form

When dealing with property transactions in Arizona, the Deed form is just one piece of the puzzle. Several other documents may accompany the Deed to ensure a smooth and legally sound transfer of property. Understanding these forms can help you navigate the process more effectively.

- Title Insurance Policy: This document protects the buyer from any claims against the property. It ensures that the title is clear and that there are no hidden issues that could affect ownership.

- Property Disclosure Statement: Sellers are often required to provide this statement, which outlines any known issues with the property. This helps buyers make informed decisions.

- Purchase Agreement: This is a contract between the buyer and seller detailing the terms of the sale, including price, contingencies, and closing date.

- Boat Bill of Sale: This document is essential for the transfer of ownership of a boat in New York, providing proof of sale and protection for both parties involved in the transaction. For more details, visit topformsonline.com.

- Affidavit of Value: This form is used to disclose the sale price of the property to the county assessor for tax purposes. It provides transparency in property transactions.

- Escrow Agreement: This document outlines the terms of the escrow process, including how funds and documents will be handled until the transaction is completed.

- Loan Documents: If financing is involved, various loan documents will be necessary. These include the mortgage agreement and promissory note, outlining the terms of the loan.

- Closing Statement: Also known as a HUD-1 statement, this document details all financial transactions related to the sale, including fees, commissions, and the final amount due.

- IRS Form 1099-S: This form is used to report the sale of real estate to the IRS. It ensures that any capital gains taxes are appropriately addressed.

Each of these documents plays a vital role in the property transaction process. By familiarizing yourself with them, you can better prepare for the responsibilities and expectations that come with buying or selling real estate in Arizona.

Consider Some Other Deed Templates for US States

What Does a House Deed Look Like in Pa - Understanding the terms within the Deed is vital for both buyers and sellers.

In order to ensure a smooth transaction when buying or selling a vehicle in California, it is important to be familiar with the California Motor Vehicle Bill of Sale form. This legal document provides detailed information about the vehicle and the involved parties, acting as a formal record of the transfer of ownership. For those seeking a straightforward approach, utilizing Fillable Forms can simplify the process and ensure all necessary details are correctly documented.

Tennessee Quitclaim Deed - Deeds may outline specific rights associated with the property, such as easements.

Similar forms

- Title Transfer Document: This document also transfers ownership of property from one party to another. Like a deed, it must be signed and often requires notarization.

- Quitclaim Deed: A quitclaim deed is a specific type of deed that transfers any interest the grantor has in the property without guaranteeing that the title is clear.

- Warranty Deed: This document provides a guarantee that the grantor holds clear title to the property. It is similar to a deed in that it transfers ownership.

- Lease Agreement: A lease agreement outlines the terms under which one party can use another party's property. It does not transfer ownership but establishes rights similar to a deed.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can be used in conjunction with a deed.

- Bill of Sale: A bill of sale transfers ownership of personal property. While it is not for real estate, it serves a similar purpose of transferring ownership.

-

Motor Vehicle Bill of Sale: This document is essential for the transfer of ownership of a vehicle, serving as proof of the transaction. It plays a crucial role in the registration process, making it imperative for both buyers and sellers to complete the transaction properly. For more details and templates, visit nyforms.com/motor-vehicle-bill-of-sale-template.

- Trust Agreement: A trust agreement can hold property on behalf of beneficiaries. It outlines how the property is managed, similar to how a deed outlines ownership.

- Property Settlement Agreement: This document is often used in divorce proceedings to divide property. It specifies how property will be transferred, akin to a deed.

Common mistakes

When filling out the Arizona Deed form, many people overlook important details that can lead to complications down the road. One common mistake is failing to include the correct legal description of the property. This description is more than just the address; it should precisely outline the boundaries and dimensions of the property. Without this information, the deed may not accurately reflect the property being transferred, which can create confusion or disputes later on.

Another frequent error is neglecting to include the names of all parties involved in the transaction. It’s essential that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are clearly stated. If a name is misspelled or omitted, it can complicate ownership rights and create issues when the deed is recorded.

People often underestimate the importance of signatures on the deed. Each party involved must sign the document, and in some cases, a notary public may need to witness these signatures. Failing to have the proper signatures can render the deed invalid. It’s crucial to ensure that all required signatures are present before submitting the document for recording.

Lastly, many individuals forget to check the recording requirements for their specific county. Each county in Arizona may have different rules regarding how a deed should be submitted, including any necessary fees or additional forms. Ignoring these requirements can lead to delays or rejections, which can be frustrating for everyone involved in the transaction.