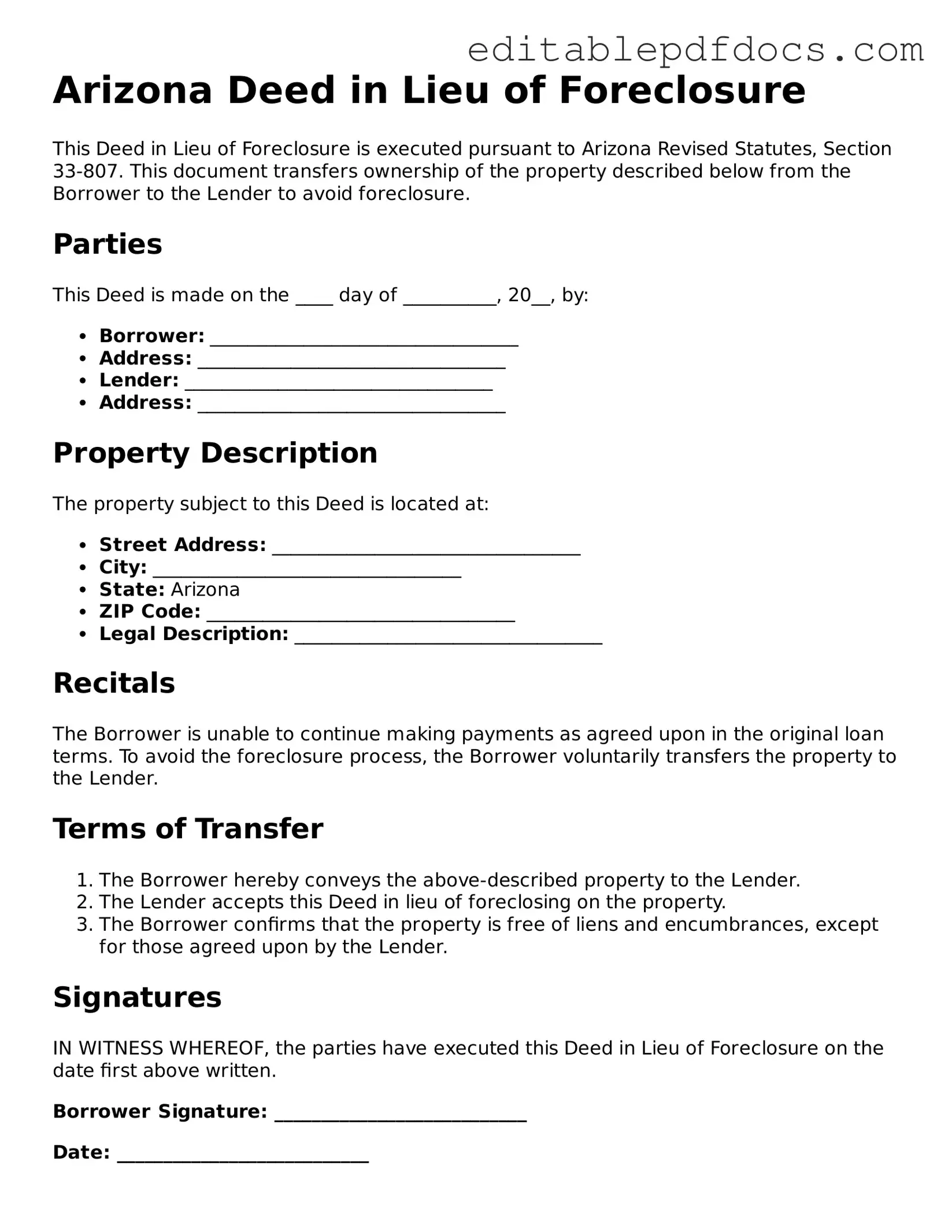

Deed in Lieu of Foreclosure Document for Arizona

In the face of mounting financial distress, homeowners in Arizona may find themselves exploring alternatives to foreclosure, and one such option is the Deed in Lieu of Foreclosure. This legal instrument allows a homeowner to voluntarily transfer their property title to the lender, effectively relinquishing ownership in exchange for the cancellation of the mortgage debt. By opting for this route, homeowners can avoid the lengthy and often painful foreclosure process, potentially preserving their credit score and allowing for a more dignified exit from their financial obligations. Key aspects of the Deed in Lieu include the necessity for the lender's acceptance, the requirement to be current on property taxes, and the importance of understanding any potential tax implications. Additionally, homeowners must ensure that they are fully aware of their rights and responsibilities throughout the process. As the real estate landscape continues to shift, understanding this option can be crucial for those seeking a swift resolution to their financial challenges.

File Information

| Fact Name | Description |

|---|---|

| Definition | An Arizona Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property back to the lender to avoid foreclosure. |

| Governing Law | This form is governed by Arizona Revised Statutes, specifically Title 33, which covers property law. |

| Eligibility | Homeowners facing financial hardship may qualify for this option if they are unable to make mortgage payments. |

| Benefits | One key benefit is that it can help borrowers avoid the lengthy foreclosure process and its associated costs. |

| Impact on Credit | A Deed in Lieu of Foreclosure may have a less severe impact on a borrower's credit score compared to a foreclosure. |

| Process | The process typically involves negotiation with the lender, completing the deed form, and transferring the property title. |

Dos and Don'ts

When filling out the Arizona Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Here are four key things to consider:

- Do ensure all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have questions. Understanding the implications of this document is crucial.

- Don't rush through the process. Take your time to understand each section of the form.

- Don't forget to keep copies of the completed form for your records. Documentation is important for future reference.

Documents used along the form

A Deed in Lieu of Foreclosure is a useful tool for homeowners facing financial difficulties. It allows them to transfer ownership of their property back to the lender, thereby avoiding the lengthy and often stressful foreclosure process. Along with this form, several other documents may be required to ensure a smooth transaction. Here are four common forms and documents that are often used in conjunction with the Arizona Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes to the original loan terms. It may be presented if the borrower and lender agree to adjust the payment structure or interest rate before proceeding with the deed in lieu. This can sometimes provide a more favorable outcome for the homeowner.

- Property Condition Disclosure: This form provides the lender with information about the property's condition. It details any known issues or repairs needed, allowing the lender to assess the property's value accurately before accepting the deed.

- Employment Verification Form: This form is critical for confirming an individual's employment status, especially when requested during the hiring process. For more information on this document, refer to Fillable Forms.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the deed in lieu is executed. It is crucial for protecting the homeowner from future claims regarding the loan.

- Affidavit of Title: This sworn statement certifies that the homeowner has clear title to the property and that there are no undisclosed liens or encumbrances. This document reassures the lender that they are receiving a property free of legal complications.

Understanding these additional documents can help homeowners navigate the process more effectively. Each one plays a vital role in ensuring that both parties are protected and that the transaction proceeds smoothly. By being prepared with the right paperwork, homeowners can alleviate some of the stress associated with financial difficulties and property ownership challenges.

Consider Some Other Deed in Lieu of Foreclosure Templates for US States

Florida Deed in Lieu of Foreclosure - By signing a Deed in Lieu, the borrower can release themselves from the mortgage debt tied to the property.

For businesses looking to establish their operations in New Jersey, understanding the importance of an accurate and detailed comprehensive Operating Agreement is vital. This document not only encapsulates the financial and functional framework of an LLC but also serves as a fundamental tool for resolving potential disagreements among members.

California Voluntary Foreclosure Deed - This form can help homeowners preserve their dignity during a challenging financial transition.

Similar forms

- Short Sale Agreement: Similar to a deed in lieu of foreclosure, a short sale allows homeowners to sell their property for less than the amount owed on the mortgage. Both options aim to relieve the financial burden on the homeowner and avoid foreclosure.

- Loan Modification Agreement: This document modifies the original loan terms to make payments more manageable for the borrower. Like a deed in lieu of foreclosure, it seeks to prevent foreclosure by addressing the homeowner's financial difficulties.

- Forbearance Agreement: A forbearance agreement allows the borrower to temporarily pause or reduce mortgage payments. This document shares similarities with a deed in lieu of foreclosure, as both provide alternatives to foreclosure by giving the homeowner time to recover financially.

- Mortgage Release or Satisfaction: This document indicates that the mortgage has been paid off or forgiven. Both a mortgage release and a deed in lieu of foreclosure signify the end of a borrower's obligation to repay the mortgage, often in a context of financial hardship.

- Disability Insurance Claim Form: The EDD DE 2501 form is crucial for Californians to report claims for Disability Insurance benefits. To understand more about completing this essential document, visit PDF Documents Hub.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a path to reorganize debts. Both bankruptcy and a deed in lieu of foreclosure are legal options available to struggling homeowners to address overwhelming financial situations.

- Property Transfer Agreement: This agreement facilitates the transfer of property ownership, often due to financial distress. Like a deed in lieu of foreclosure, it can help relieve the homeowner from a burdensome mortgage obligation.

- Real Estate Owned (REO) Agreement: An REO agreement involves properties that have been foreclosed and are owned by the lender. While it occurs after foreclosure, it shares the goal of resolving the homeowner's financial issues, similar to a deed in lieu of foreclosure.

- Quitclaim Deed: A quitclaim deed transfers ownership rights from one party to another without warranties. This document, while different in intent, can be used in situations where a homeowner wishes to relinquish their interest in the property, akin to a deed in lieu of foreclosure.

Common mistakes

Filling out the Arizona Deed in Lieu of Foreclosure form can be a straightforward process, but there are common mistakes that individuals often make. One prevalent error is not providing accurate property information. Ensuring that the property address and legal description are correct is essential. Inaccuracies can lead to delays or complications in the transfer process.

Another mistake involves failing to sign the document properly. All required parties must sign the form for it to be valid. Omitting a signature can invalidate the deed, making it ineffective in transferring ownership. Additionally, not having the signatures notarized can also pose problems. Notarization is often a required step in making the document legally binding.

People frequently overlook the importance of understanding the implications of the deed. A Deed in Lieu of Foreclosure can have significant consequences, such as affecting credit scores and future homeownership opportunities. Therefore, it is crucial to consult with a financial advisor or attorney before proceeding.

Another common oversight is neglecting to include any necessary attachments. Sometimes, additional documentation is required to support the deed. This may include a statement of the mortgage balance or other relevant financial information. Failing to include these documents can delay the process.

Some individuals also make the mistake of not checking for liens or other encumbrances on the property. Before signing the deed, it is vital to ensure that there are no outstanding debts associated with the property. If there are existing liens, the lender may not accept the deed.

Moreover, people sometimes rush through the form without reading all instructions carefully. Each section of the form must be completed as directed. Misinterpretation of the instructions can lead to incomplete or incorrect submissions.

Another frequent error is not notifying the lender of the intent to execute a Deed in Lieu of Foreclosure. Communication with the lender is essential throughout this process. Failing to do so may lead to misunderstandings or even legal complications.

Additionally, individuals may underestimate the timeline involved in processing the deed. It is important to allow sufficient time for the lender to review and accept the deed. Rushing this process can lead to further complications.

Finally, some people forget to keep copies of all documents submitted. Retaining copies of the signed deed and any related correspondence is crucial for future reference. This can help protect your interests should any issues arise after the transfer.