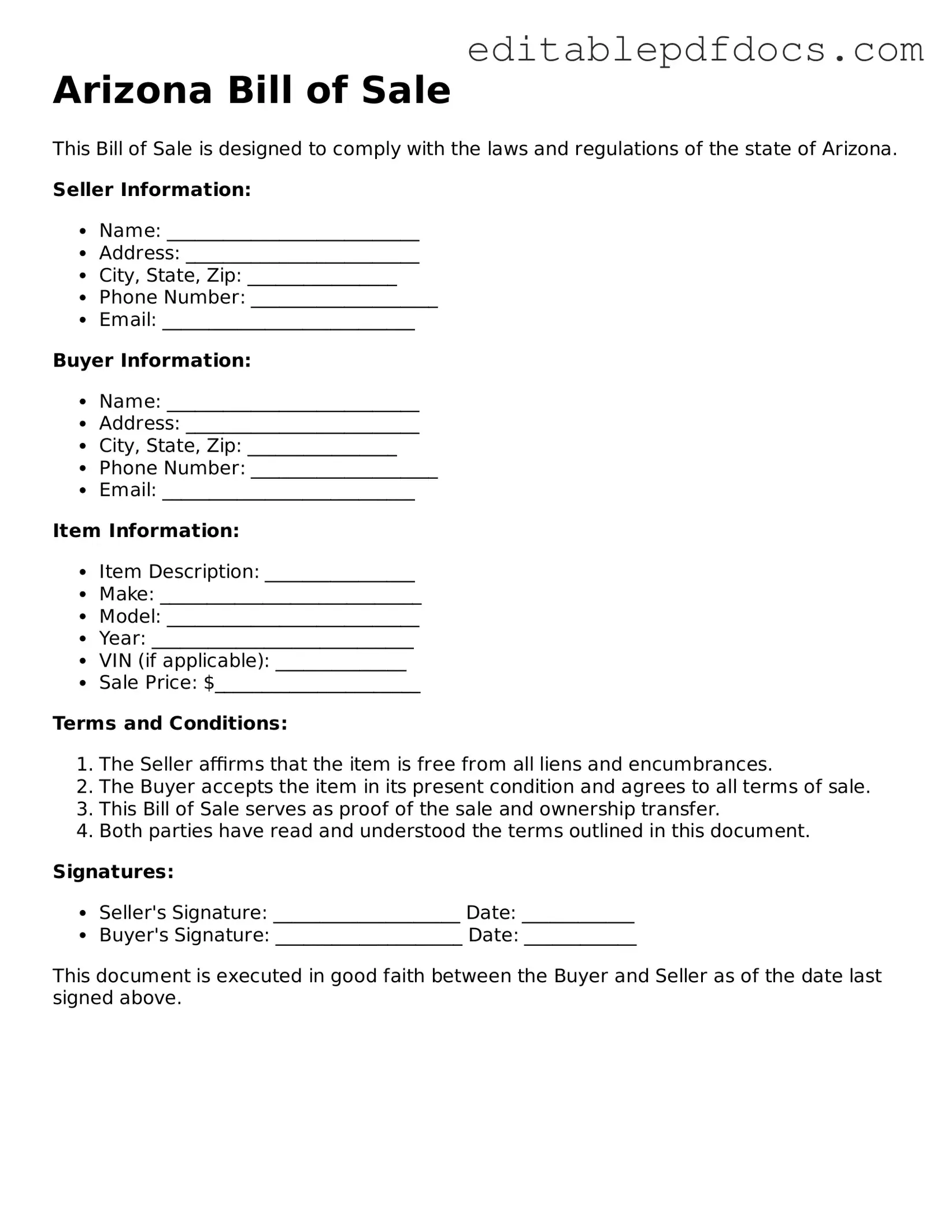

Bill of Sale Document for Arizona

The Arizona Bill of Sale form serves as a crucial document in the process of transferring ownership of personal property, such as vehicles, boats, and other tangible items. This form not only provides a written record of the transaction but also offers protection for both the buyer and the seller. It typically includes essential details such as the names and addresses of both parties, a description of the item being sold, the sale price, and the date of the transaction. Additionally, the Bill of Sale may outline any warranties or conditions related to the sale, ensuring that both parties have a clear understanding of their rights and responsibilities. In Arizona, having a properly completed Bill of Sale can simplify the process of registering the item with state authorities and may be required for certain types of property transfers. Understanding the significance of this form is vital for anyone engaging in a sale or purchase, as it helps to establish a transparent and legally recognized agreement between the involved parties.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one party to another. |

| Governing Law | The Bill of Sale in Arizona is governed by Arizona Revised Statutes, specifically Title 44, Chapter 2. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required for all transactions, it is recommended to add an extra layer of authenticity. |

| Buyer and Seller Information | The form must include the full names and addresses of both the buyer and the seller to ensure clear identification. |

| Purchase Price | The purchase price of the item being sold must be clearly stated in the Bill of Sale. |

| Condition of Item | It's advisable to include a description of the item's condition to avoid disputes later on. |

| As-Is Clause | Many Bills of Sale include an "as-is" clause, indicating that the buyer accepts the item in its current state without warranties. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

| Transfer of Title | For vehicles, a Bill of Sale is often required to complete the transfer of title with the Arizona Department of Transportation. |

Dos and Don'ts

When filling out the Arizona Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn't do.

- Do provide accurate information about the buyer and seller.

- Do include a detailed description of the item being sold.

- Do specify the purchase price clearly.

- Do sign and date the document in the appropriate sections.

- Do keep a copy for your records after completion.

- Don't leave any fields blank; fill out all required sections.

- Don't use vague language; be specific in your descriptions.

- Don't forget to include any applicable sales tax information.

- Don't alter the form after it has been signed.

- Don't ignore local regulations that may apply to your sale.

Following these guidelines will help ensure that your Bill of Sale is valid and serves its intended purpose. Always double-check your information before finalizing the document.

Documents used along the form

When engaging in a sale or transfer of personal property in Arizona, the Bill of Sale is a crucial document. However, it is often accompanied by other forms and documents that help clarify the transaction and protect both parties involved. Below is a list of common forms that may be used alongside the Arizona Bill of Sale.

- Title Transfer Form: This document is essential for transferring ownership of vehicles. It officially changes the title from the seller to the buyer, ensuring that the new owner is recognized legally.

- Vehicle Registration Application: For vehicle sales, this form is necessary to register the newly acquired vehicle in the buyer's name. It includes details about the vehicle and the new owner.

- Odometer Disclosure Statement: This form is required when selling a vehicle. It certifies the mileage on the vehicle at the time of sale, protecting the buyer from potential fraud.

- Affidavit of Identity: This document may be needed to confirm the identity of the seller, especially in cases where the seller's name does not match the title or other documents.

- Sales Tax Form: In Arizona, sales tax may apply to certain transactions. This form helps document the sales tax collected and ensures compliance with state regulations.

- Warranty Deed: For real estate transactions, a warranty deed transfers ownership and provides a guarantee that the property is free of liens, giving the buyer peace of mind.

- California ATV Bill of Sale: This form is crucial for recording the sale of an all-terrain vehicle in California, ensuring both parties are protected during the transaction, and can be accessed via the ATV Bill of Sale form.

- Purchase Agreement: This is a contract that outlines the terms and conditions of the sale. It details the purchase price, payment methods, and any contingencies related to the sale.

- Inspection Report: Often used in vehicle or property sales, this report provides an assessment of the condition of the item being sold, helping buyers make informed decisions.

Each of these documents plays a vital role in ensuring a smooth transaction. By understanding their purposes and how they complement the Arizona Bill of Sale, both buyers and sellers can navigate the process with confidence.

Consider Some Other Bill of Sale Templates for US States

Trailer Bill of Sale Georgia - For sellers, this document can verify that they are no longer the owner of the item.

Additionally, for a comprehensive guide on how to manage employment-related documentation, you may want to refer to the resources available at PDF Documents Hub, which can assist you in the verification process and provide useful tips.

Motor Vehicle Bill of Sale Form - A straightforward way to document sales without legal complexities.

Tn Bill of Sale Pdf - This form can be customized for different types of sales, ensuring it meets specific needs.

Washington State Bill of Sale - This form can also provide a history of ownership, which can be beneficial for future transactions.

Similar forms

- Purchase Agreement: This document outlines the terms of a sale between a buyer and a seller. Like a Bill of Sale, it serves as proof of the transaction and details the items being sold, including price and conditions.

- Lease Agreement: A lease agreement establishes the terms under which one party rents property from another. Similar to a Bill of Sale, it provides legal protection and clarity regarding the rights and responsibilities of both parties.

- Operating Agreement: To define your LLC's operational structure, refer to our comprehensive Operating Agreement resources for guidance on necessary details and management roles.

- Title Transfer Document: This document is used to officially transfer ownership of a vehicle or property. It operates similarly to a Bill of Sale by providing evidence of the change in ownership.

- Sales Receipt: A sales receipt is a proof of purchase that details the items bought and the amount paid. While it may not transfer ownership, it functions similarly by confirming the transaction.

- Contract for Deed: This document outlines the terms for purchasing property over time. It is akin to a Bill of Sale as it establishes the buyer's rights to the property while payments are being made.

- Warranty Deed: A warranty deed is used to guarantee that the seller has the right to sell the property and that the title is clear. Like a Bill of Sale, it provides assurance to the buyer regarding ownership rights.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It is similar to a Bill of Sale in that it can authorize the sale of property or assets.

- Gift Deed: A gift deed is used to transfer property without any exchange of money. It resembles a Bill of Sale as it also serves as a record of the transfer of ownership.

- Inventory List: An inventory list details items owned, often used in business transactions. Like a Bill of Sale, it provides a record of what is being sold or transferred.

- Affidavit of Sale: This document is a sworn statement affirming the sale of an item. It parallels a Bill of Sale by serving as a formal declaration of the transaction.

Common mistakes

Filling out a Bill of Sale in Arizona is a straightforward process, but many people make common mistakes that can lead to confusion or legal issues later on. One frequent error occurs when individuals forget to include the date of the transaction. This date is crucial because it establishes when the ownership of the item officially changes hands. Without it, disputes may arise regarding the timeline of the sale.

Another common mistake is neglecting to provide accurate personal information. Sellers and buyers should include their full names, addresses, and contact details. Incomplete or incorrect information can create complications if any follow-up is necessary or if a dispute arises. Always double-check these details to ensure they are correct.

People often overlook the importance of describing the item being sold. A vague description can lead to misunderstandings about what is being purchased. It’s essential to include specific details such as the make, model, year, and any identifying numbers, like a VIN for vehicles. This clarity protects both parties and helps prevent future disputes.

Many individuals also forget to include the purchase price in the Bill of Sale. This figure is not just a formality; it serves as a record of the transaction for both parties. Without this, it may be difficult to prove the value of the item for tax purposes or in case of any legal issues that may arise later.

Failing to have the document signed by both parties is another mistake that can render the Bill of Sale ineffective. Both the buyer and seller should sign the document to acknowledge their agreement to the terms outlined within it. A lack of signatures can lead to disputes over whether the sale took place at all.

Some people might also forget to include any warranties or guarantees related to the sale. If the seller is providing any assurances about the condition of the item or its functionality, these should be clearly stated in the Bill of Sale. This protects the buyer and sets clear expectations for both parties.

Another mistake is not keeping a copy of the Bill of Sale for personal records. Both the buyer and seller should retain a copy of the signed document. This serves as proof of the transaction and can be invaluable for future reference, especially for tax or legal matters.

People sometimes fail to check for local laws or regulations regarding Bill of Sale requirements. While Arizona has general guidelines, specific items may have additional requirements. For instance, vehicle sales may require more detailed documentation. Understanding these nuances can save time and avoid potential legal issues.

Additionally, some individuals may rush through the process and not read the entire document carefully. It’s essential to understand what you are signing. Taking the time to review the Bill of Sale ensures that all terms are clear and that both parties are in agreement.

Finally, neglecting to consider notarization can be a mistake, especially for high-value transactions. While notarization is not always required in Arizona, having the document notarized can provide an additional layer of protection and authenticity. It can be beneficial if disputes arise in the future.