Articles of Incorporation Document for Arizona

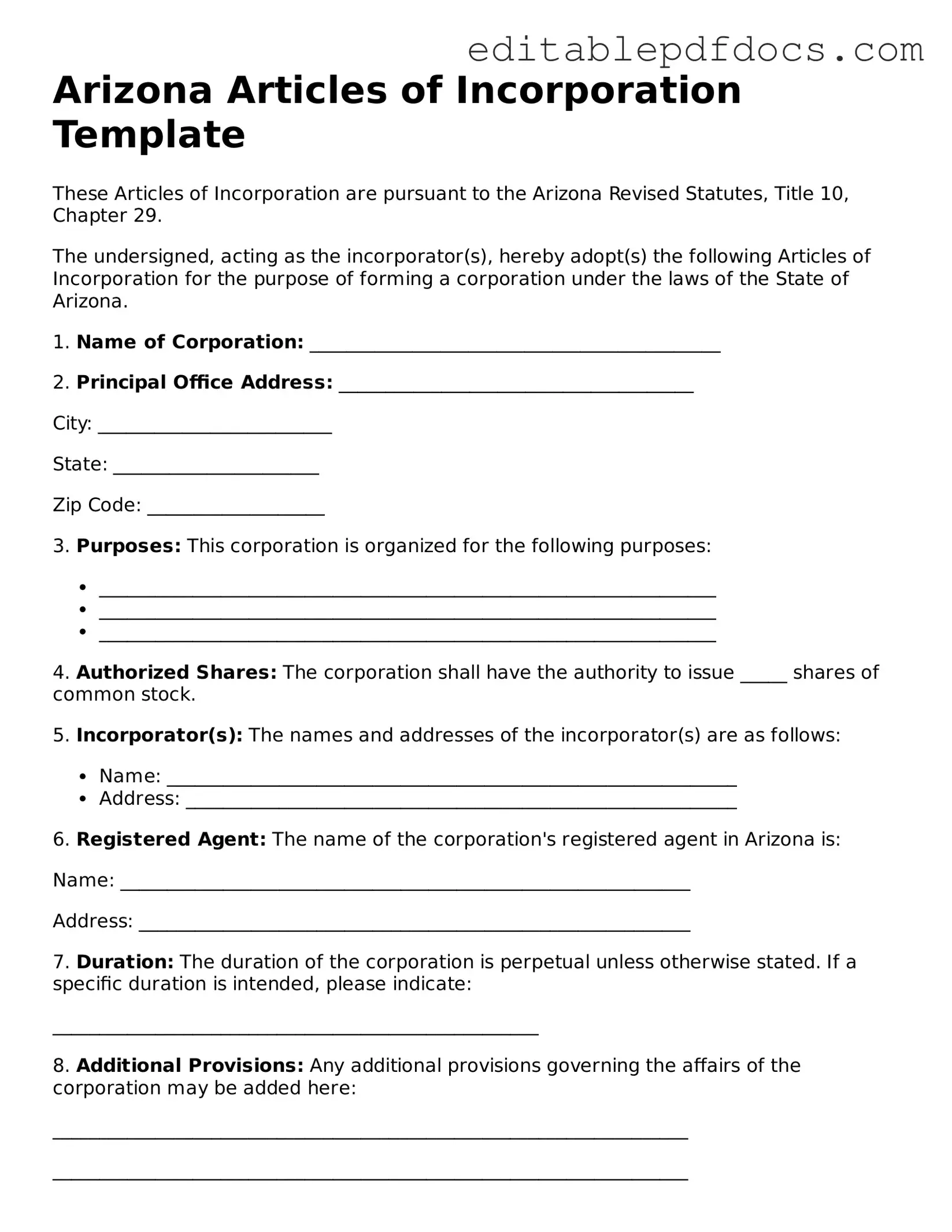

When starting a business in Arizona, one of the first essential steps is to complete the Articles of Incorporation form. This document serves as the foundation for your corporation, outlining key details that define your business structure. It requires you to provide basic information such as the corporation's name, which must be unique and comply with state regulations. Additionally, you will need to specify the purpose of your corporation, which can range from providing goods and services to engaging in various business activities. The form also requires the designation of a statutory agent, who will serve as the point of contact for legal documents. Furthermore, it includes provisions for the number of shares the corporation is authorized to issue, which is crucial for establishing ownership and investment opportunities. Completing this form accurately is vital, as it not only ensures compliance with state laws but also protects your personal assets by establishing a separate legal entity. Taking the time to understand and properly fill out the Articles of Incorporation can pave the way for a successful business venture in Arizona.

File Information

| Fact Name | Details |

|---|---|

| Document Title | Arizona Articles of Incorporation |

| Governing Law | Arizona Revised Statutes, Title 10, Chapter 2 |

| Purpose | To legally establish a corporation in Arizona. |

| Filing Requirement | Must be filed with the Arizona Corporation Commission. |

| Filing Fee | The standard fee is $60, but additional fees may apply. |

| Minimum Information | Includes corporation name, duration, and address. |

| Registered Agent | A registered agent must be designated in the form. |

| Effective Date | The corporation can specify an effective date for formation. |

| Amendments | Articles can be amended after incorporation if needed. |

Dos and Don'ts

When filling out the Arizona Articles of Incorporation form, it is essential to approach the process with care. Here are some important guidelines to follow:

- Do: Ensure that all information is accurate and complete. Double-check names, addresses, and other details.

- Do: Use clear and concise language throughout the form. Avoid unnecessary jargon that may confuse the reader.

- Do: Include the required signatures. This step is crucial for the validation of the document.

- Do: Keep a copy of the completed form for your records. This will be helpful for future reference.

- Don't: Rush through the form. Taking your time can help prevent mistakes that may delay the process.

- Don't: Leave any sections blank unless instructed otherwise. Every part of the form must be addressed.

- Don't: Use outdated information. Ensure that all details reflect your current business status.

- Don't: Forget to review the filing fees. Confirm the amount and payment method before submission.

Documents used along the form

When forming a corporation in Arizona, several documents are often needed in addition to the Articles of Incorporation. These documents help ensure compliance with state laws and provide necessary information for your business operations. Below is a list of commonly used forms and documents.

- Bylaws: Bylaws outline the internal rules and procedures for managing the corporation. They cover topics such as board meetings, voting rights, and the roles of officers.

- Employment Application PDF Form: This essential document allows job seekers to effectively communicate their qualifications and experiences to potential employers. To access the form, visit PDF Documents Hub.

- Initial Report: This document provides the state with information about the corporation’s officers and directors shortly after incorporation. It helps maintain transparency and accountability.

- Employer Identification Number (EIN): An EIN is a unique number assigned by the IRS for tax purposes. It is necessary for opening a business bank account and hiring employees.

- Business Licenses: Depending on the nature of the business, various local, state, or federal licenses may be required. These licenses allow the corporation to operate legally within its industry.

- Operating Agreement: While more common for LLCs, corporations may also benefit from an operating agreement. This document outlines the management structure and operational procedures.

- Shareholder Agreement: This agreement details the rights and responsibilities of shareholders. It can help prevent disputes and clarify how shares can be bought or sold.

These documents play a crucial role in establishing a solid foundation for your corporation. Ensuring that all necessary paperwork is completed accurately can help avoid legal complications in the future.

Consider Some Other Articles of Incorporation Templates for US States

How to Incorporate in Tennessee - Keep a copy of the filed Articles in your business records for future reference.

When applying for a position at Chick-fil-A, it is essential to have a clear understanding of the process to maximize your chances of success. To streamline your application experience, you can access a variety of resources, including the Fillable Forms that simplify the submission of your information.

Pennsylvania Department of Corporations - The document may require signatures from incorporators or directors.

Similar forms

- Bylaws: Bylaws outline the internal rules and regulations for the management of a corporation. Similar to Articles of Incorporation, they establish the framework for the organization but focus more on operational procedures.

- Operating Agreement: This document is used by LLCs and serves a similar purpose to Articles of Incorporation. It details the ownership and management structure, as well as the rights and responsibilities of members.

- Residential Lease Agreement: For those renting residential properties, consult our detailed Residential Lease Agreement guidelines to ensure all terms are clear and legally binding.

- Certificate of Incorporation: Often used interchangeably with Articles of Incorporation, this document is filed with the state to officially create a corporation. It contains similar information, such as the business name and purpose.

- Partnership Agreement: This document outlines the terms of a partnership, including roles, contributions, and profit-sharing. Like Articles of Incorporation, it formalizes the relationship among parties involved.

- Business License: A business license permits a company to operate legally within a specific jurisdiction. While it does not establish the company’s structure, it is essential for compliance, much like the Articles of Incorporation.

- Tax Identification Number (TIN) Application: This application is necessary for tax purposes and is similar in that it is a foundational document for establishing a business entity, allowing it to operate legally.

- Shareholder Agreement: This document governs the relationship between shareholders, detailing rights and obligations. It is similar to Articles of Incorporation as it defines ownership and management aspects of a corporation.

- Certificate of Good Standing: This certificate verifies that a corporation is compliant with state regulations. While it does not create a corporation, it serves as proof of the entity's legal status, similar to the Articles of Incorporation.

- Annual Report: Corporations are often required to file annual reports to maintain their good standing. This document provides updates on business activities and is similar in that it keeps the state informed about the corporation’s status.

Common mistakes

Filing the Arizona Articles of Incorporation is a crucial step for anyone looking to establish a corporation in the state. However, many individuals make common mistakes that can lead to delays or complications in the incorporation process. Understanding these pitfalls can help ensure a smoother experience.

One frequent mistake is failing to select the correct entity type. Arizona offers various types of corporations, such as for-profit, nonprofit, and professional corporations. Choosing the wrong type can result in legal and operational challenges down the line.

Another common error is neglecting to provide a registered agent's information. A registered agent is essential for receiving legal documents on behalf of the corporation. Omitting this information can lead to missed notifications and potential legal repercussions.

Many applicants overlook the importance of a clear business name. The name must be unique and not too similar to existing entities. Failing to verify the availability of a business name can result in rejection of the application.

Inaccurate or incomplete information is another significant issue. Each section of the form must be filled out carefully. Even small errors, such as typos or missing details, can cause delays in processing.

Some individuals forget to include the purpose of the corporation. This section is vital as it outlines the business's intended activities. A vague or overly broad description can lead to questions from the state and may require additional clarification.

Additionally, applicants sometimes neglect to specify the number of shares the corporation is authorized to issue. This detail is important for understanding ownership and investment opportunities. Without it, the application may be deemed incomplete.

Not including the names and addresses of the initial directors is another mistake. This information is essential for establishing the governance structure of the corporation. Omitting it can hinder the approval process.

Some people fail to sign the Articles of Incorporation. A signature is a simple yet critical requirement that confirms the applicant's intent to form the corporation. Without a signature, the form is invalid.

Finally, many applicants do not pay the required filing fee. Each type of corporation has a specific fee that must accompany the application. Forgetting this step can lead to immediate rejection of the filing.

By being aware of these common mistakes, individuals can enhance their chances of successfully filing the Arizona Articles of Incorporation. Attention to detail and thorough preparation can make a significant difference in the incorporation process.