Fill a Valid Alabama Mvt 20 1 Template

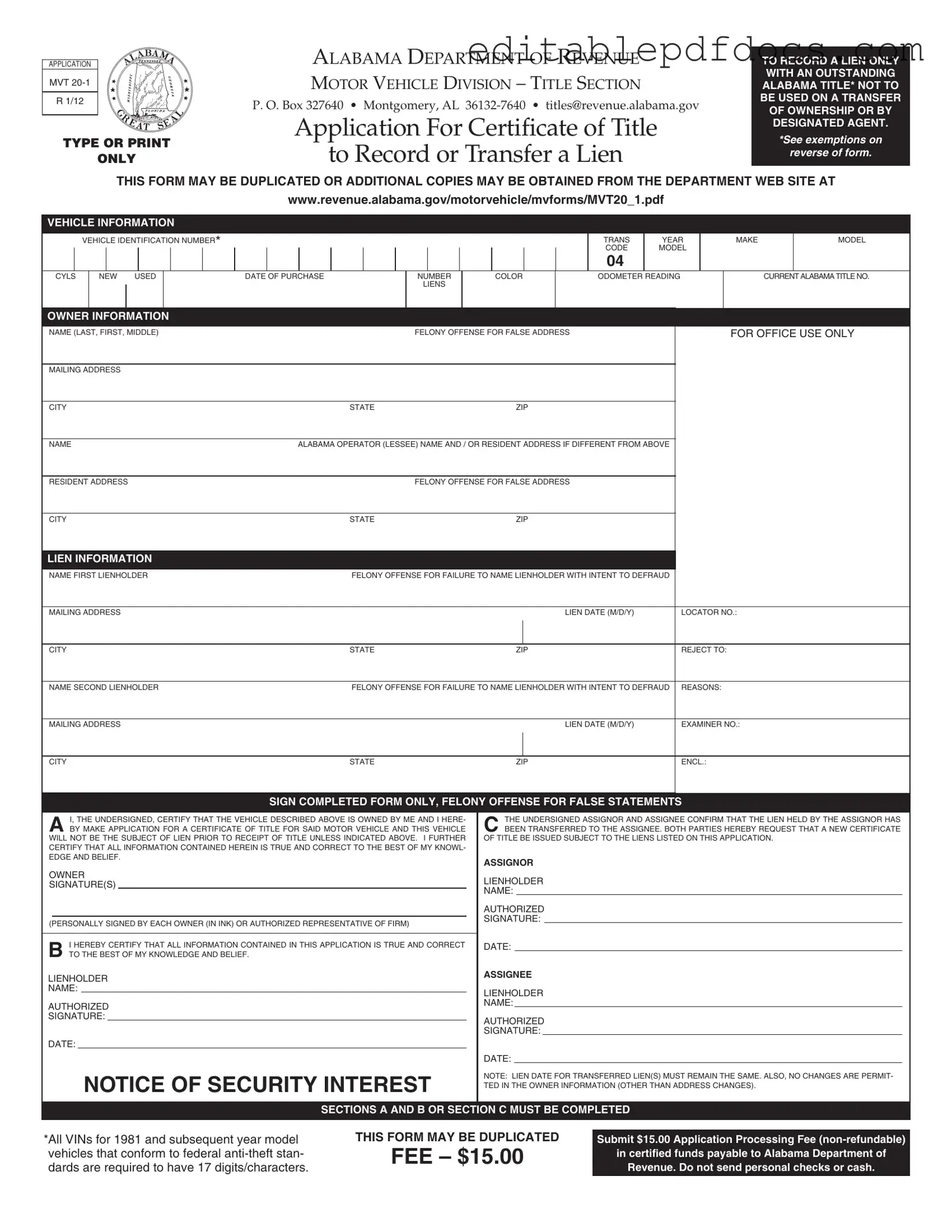

The Alabama Mvt 20 1 form is a crucial document for vehicle owners and lienholders in the state of Alabama. This application is specifically designed for those looking to record or transfer a lien on a motor vehicle that has an outstanding Alabama title. It is important to note that this form should not be used for transferring ownership or by designated agents. The application requires detailed vehicle information, including the vehicle identification number (VIN), make, model, and odometer reading, along with the owner's information and any existing lienholder details. A processing fee of $15 must accompany the application, and it is mandatory to submit the current Alabama title along with the form. The Alabama Department of Revenue emphasizes the need for legibility, as illegible forms will be returned. Furthermore, certain exemptions apply to this form, such as vehicles older than 35 model years and specific types of trailers, which are not eligible for titling. Understanding these aspects is essential for ensuring compliance with Alabama's vehicle title regulations and avoiding unnecessary delays in the lien recording process.

Document Details

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to apply for a certificate of title to record or transfer a lien on a vehicle. |

| Governing Law | The form is governed by Section 32-8-61 of the Code of Alabama 1975. |

| Fee Requirement | A $15.00 application processing fee is required, payable in certified funds only. |

| Eligibility | The form is only for vehicles with an outstanding Alabama title. It cannot be used for ownership transfers. |

| VIN Requirement | Vehicles from 1981 onward must have a 17-digit Vehicle Identification Number (VIN). |

| Supporting Documents | The current Alabama title for the vehicle must accompany the application. |

| Exemptions | Vehicles over 35 years old or certain types of trailers may be exempt from titling. |

Dos and Don'ts

When filling out the Alabama MVT 20 1 form, follow these guidelines to ensure accuracy and compliance.

- Do: Type or print the application legibly to avoid rejection.

- Do: Include the correct Vehicle Identification Number (VIN) as it appears on the current title.

- Do: Provide accurate owner and lienholder information, ensuring it matches the existing title.

- Do: Sign the completed form in ink; electronic signatures are not accepted.

- Do: Submit the application with the required $15 processing fee in certified funds.

- Don't: Use this form for transferring ownership; it is strictly for lien recording.

- Don't: Submit personal checks or cash; only certified funds are acceptable.

- Don't: Leave any required fields blank; incomplete forms will be returned.

- Don't: Alter any information after submission; changes are not permitted.

- Don't: Ignore the exemptions; ensure your vehicle is eligible for titling before applying.

Documents used along the form

The Alabama MVT 20 1 form is essential for recording or transferring a lien on a motor vehicle in Alabama. When dealing with vehicle titles and liens, several other documents may be necessary to ensure a smooth process. Here are some commonly used forms and documents that often accompany the MVT 20 1 form.

- MVT 5-1E Form: This form is specifically designed for designated agents to record liens. It is used when a lienholder wants to create a security interest in a vehicle but is not the owner. This form ensures that the lien is properly documented in accordance with Alabama law.

- Bill of Sale: A Bill of Sale serves as a legal document that records the sale of a vehicle from one party to another. It includes details such as the vehicle identification number (VIN), sale price, and the names of both the buyer and seller. This document is crucial for establishing ownership and can be required when applying for a new title.

- Application for Duplicate Title: If the original title is lost, stolen, or damaged, this application allows the vehicle owner to request a duplicate title from the Alabama Department of Revenue. This form ensures that the owner can still prove ownership and transfer the title as needed.

- Power of Attorney: This document grants a designated individual the authority to act on behalf of the vehicle owner in matters related to the vehicle's title and lien. It is particularly useful when the owner cannot be present to sign necessary documents.

- California Trailer Bill of Sale - This form is essential for transferring ownership of a trailer in California, and it is crucial to complete it for a seamless transaction. More information can be found at Fillable Forms.

- Notice of Security Interest: This notice is filed to inform the public that a lien exists on a vehicle. It provides legal notice to any potential buyers or creditors that the vehicle is encumbered by a security interest, protecting the lienholder's rights.

- Title Transfer Form: When ownership of a vehicle changes hands, this form facilitates the transfer of the title from the seller to the buyer. It includes necessary information about both parties and the vehicle, ensuring that the new owner is properly documented in the state’s records.

Understanding these forms and documents is vital for anyone involved in vehicle transactions in Alabama. Properly completing and submitting the required paperwork can help avoid complications and ensure that all legal obligations are met.

Popular PDF Forms

Affidavit of Death of Joint Tenant - Enhances communication among all parties involved with the trust.

For couples considering marriage, understanding the implications of a detailed New Jersey Prenuptial Agreement is crucial. This document serves to clarify the financial responsibilities and asset management for both parties, ensuring that their intentions are legally recognized and protected ahead of time.

Custody Affidavit - Clear instructions are provided for the notarization and witness requirements.

Similar forms

The Alabama Mvt 20 1 form is used primarily for recording or transferring a lien on a vehicle. Several other documents serve similar purposes in vehicle title and lien management. Below is a list of ten documents that are comparable to the Mvt 20 1 form, along with a brief explanation of their similarities.

- MVT 5-1E: This form is used by designated agents to record liens. Like the Mvt 20 1, it facilitates the lien process but is specifically for agents rather than vehicle owners.

- MVT 5-1: This document is utilized for the transfer of ownership of a vehicle. It includes lien information and is similar in that it requires details about the vehicle and parties involved.

- MVT 5-2: This form is for applying for a duplicate title when the original is lost or destroyed. Both forms require vehicle identification and owner information.

- MVT 10: This is the application for a title for a vehicle that has never been titled before. Similar to the Mvt 20 1, it collects essential vehicle and owner details.

- MVT 20-2: This form is used to release a lien on a vehicle. It serves a similar function in documenting changes to lien status.

- MVT 5-3: This document is for the application for a title for a vehicle purchased from a dealer. It shares the same purpose of facilitating title transfer and lien recording.

- MVT 5-4: This form is used to apply for a title for a vehicle that has been abandoned. It requires similar vehicle information and serves to establish ownership.

- New York Certificate of Incorporation: This document is essential for legally establishing a corporation in New York, detailing key aspects such as name, purpose, and share structure. More information can be found at https://nyforms.com/new-york-certificate-template.

- MVT 5-5: This form is for the application of a title for a vehicle that has been repossessed. Like the Mvt 20 1, it deals with lien situations and vehicle ownership.

- MVT 5-6: This document is used for the application of a title for a vehicle that has been inherited. It also involves lien information, akin to the Mvt 20 1.

- MVT 5-7: This form is for the application of a title for a vehicle that has been gifted. Similar to the Mvt 20 1, it requires details about the vehicle and the new owner.

Each of these forms plays a role in managing vehicle titles and liens, ensuring that the necessary information is documented and processed correctly.

Common mistakes

Completing the Alabama MVT 20 1 form can be straightforward, but many individuals make critical mistakes that can delay processing. One common error is failing to provide a complete Vehicle Identification Number (VIN). The VIN must be exactly 17 characters for vehicles from 1981 onward. If the VIN is incorrect or incomplete, the application will be rejected.

Another frequent mistake involves the vehicle information section. Applicants often overlook the requirement that the vehicle information must match the details on the current Alabama title. Discrepancies can lead to unnecessary complications. Ensure that the make, model, and year of the vehicle are accurately reflected.

Many people also neglect to check the odometer reading. This reading must be reported accurately. Misstating the odometer can result in legal repercussions and complications in the title transfer process. It’s essential to record this information carefully.

In the owner information section, individuals sometimes fail to include all required names. If there are multiple owners, each must be listed. Omitting an owner can lead to delays or rejection of the application. Clarity is crucial in this section.

Another mistake involves the mailing address. Applicants often provide an address that does not match the one on the current title. If the address differs, it can create confusion and lead to further inquiries from the Department of Revenue.

People also frequently forget to sign the form. The application must be signed by all owners or authorized representatives. A missing signature will result in automatic rejection. Therefore, double-check that all required signatures are present.

Submitting the application without the required fee is another common error. The fee must be $15 in certified funds, and personal checks or cash are not accepted. Applications lacking the correct payment will not be processed.

Additionally, applicants often fail to include supporting documents. The current Alabama title must accompany the application. Without this document, the application cannot proceed, causing unnecessary delays.

Some individuals mistakenly believe that they can make changes to the owner information after submitting the form. However, changes are not permitted, except for address updates. This misunderstanding can lead to further complications and delays.

Finally, people sometimes do not read the instructions thoroughly. The form explicitly states that it should be typed or printed legibly. Illegible forms will be returned, wasting time and effort. Taking the time to read the instructions can save significant hassle.