Fill a Valid Adp Pay Stub Template

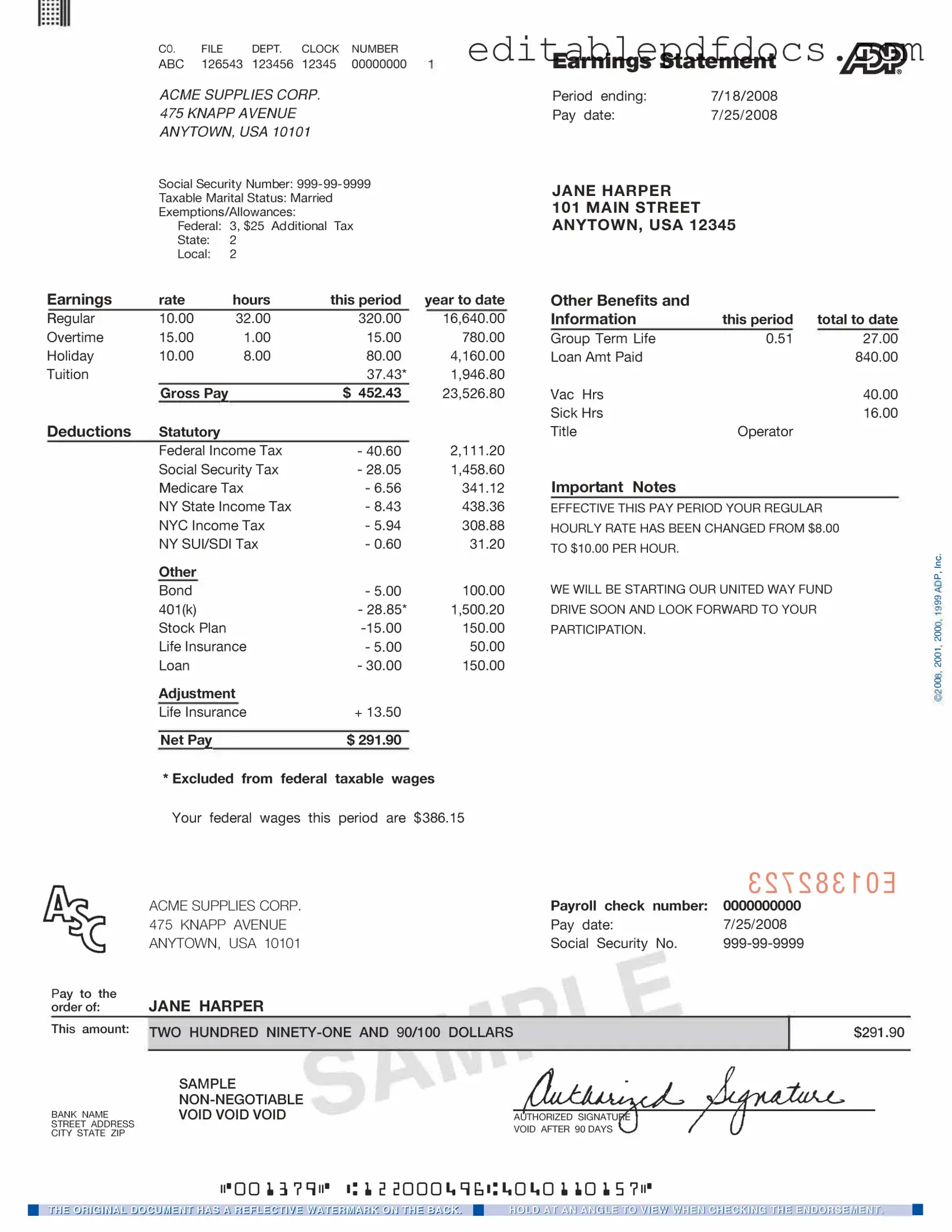

The ADP Pay Stub form serves as a crucial document for employees, providing a clear breakdown of their earnings and deductions for each pay period. It typically includes essential information such as the employee's name, pay period dates, and total hours worked. Additionally, the form details gross pay, taxes withheld, and various deductions like health insurance and retirement contributions. Understanding this document is vital for employees to track their earnings accurately and ensure that all deductions are correct. Furthermore, the pay stub may also show year-to-date earnings, which helps employees keep an eye on their financial progress throughout the year. With its straightforward layout, the ADP Pay Stub form aims to make payroll information accessible and easy to understand, empowering employees to take control of their financial well-being.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for each pay period. |

| Components | The pay stub typically includes gross pay, net pay, taxes withheld, and other deductions such as retirement contributions or health insurance premiums. |

| Frequency | Employees receive the ADP Pay Stub form each pay period, which can be weekly, bi-weekly, or monthly, depending on the employer's payroll schedule. |

| State-Specific Requirements | Some states have specific laws requiring employers to provide detailed pay stubs. For example, California law mandates that pay stubs must include the pay period dates and the employee's name. |

| Access | Employees can access their pay stubs online through ADP's portal or receive them via traditional mail, depending on their employer's preference. |

| Tax Implications | The information on the pay stub is crucial for employees when filing their taxes, as it shows total earnings and tax withholdings for the year. |

| Record Keeping | Employees are encouraged to keep their pay stubs for their records, as they can be useful for verifying income when applying for loans or other financial services. |

Dos and Don'ts

When filling out the ADP Pay Stub form, attention to detail is crucial. Here are some key actions to take and avoid.

- Do: Ensure all personal information is accurate, including your name, address, and Social Security number.

- Do: Double-check your hours worked and any overtime to reflect your actual earnings.

- Do: Review deductions carefully to understand how much is being taken out for taxes, insurance, and retirement plans.

- Do: Keep a copy of your completed pay stub for your records.

- Don't: Leave any fields blank; incomplete information can lead to processing delays.

- Don't: Use incorrect or outdated forms; always use the latest version of the ADP Pay Stub form.

- Don't: Ignore discrepancies; if something seems off, address it with your employer or payroll department immediately.

- Don't: Forget to sign and date the form if required; this step is often necessary for validation.

Documents used along the form

When managing payroll and employee compensation, several documents work in tandem with the ADP Pay Stub form. Each of these documents serves a specific purpose, ensuring that both employers and employees have a clear understanding of wages, deductions, and tax obligations.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. Employers must provide it to employees by January 31 each year, allowing employees to file their income taxes accurately.

- Pay Schedule: A document outlining the frequency of pay periods, such as weekly, bi-weekly, or monthly. This helps employees know when to expect their paychecks.

- FedEx Release Form: This crucial document allows you to authorize the delivery of your package when you're unable to be home. Ensure you follow the instructions carefully to guarantee a smooth delivery process—click here to access the PDF Documents Hub to fill out the form now.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their pay directly into their bank account. It streamlines the payment process and ensures timely access to funds.

- Employee Tax Withholding Certificate (W-4): Employees use this form to indicate their tax withholding preferences. It helps employers calculate the correct amount of federal income tax to withhold from each paycheck.

- Time Sheets: These documents track the hours worked by employees. They are essential for calculating pay, especially for hourly workers, and ensure accurate compensation for hours worked.

- Benefits Enrollment Forms: These forms allow employees to enroll in or make changes to their benefits, such as health insurance and retirement plans. They help ensure that employees receive the benefits they are entitled to.

Understanding these documents can help both employees and employers navigate payroll processes more effectively. Each plays a vital role in ensuring clarity and compliance in compensation practices.

Popular PDF Forms

Size of 96 Well Plate - The form's simplicity allows for rapid familiarization and usage.

For anyone looking to make important decisions regarding their estate, a well-crafted document like a reliable Last Will and Testament template can provide invaluable guidance. Visit this link for helpful resources: accessible Last Will and Testament forms that can simplify the process for you.

Bol Definition - It outlines the terms and conditions governing the shipment of goods.

Similar forms

The ADP Pay Stub form is a vital document that provides employees with a detailed breakdown of their earnings and deductions. Similar documents serve comparable purposes in tracking income and expenses. Here are eight documents that share similarities with the ADP Pay Stub:

- W-2 Form: This form is issued by employers at the end of the year and summarizes an employee's total earnings and tax withholdings for the year. Like the pay stub, it helps in understanding annual income and tax obligations.

- 1099 Form: Used for independent contractors, this form reports income received outside of traditional employment. It highlights earnings, similar to how a pay stub breaks down wages and deductions.

- Paycheck: The physical or electronic payment made to an employee for their work. It often includes similar information to the pay stub, detailing gross pay, deductions, and net pay.

Lease Agreement: To ensure a clear understanding of rental terms, refer to the essential details for a Lease Agreement template that outlines obligations and conditions for both parties involved.

- Direct Deposit Receipt: When employees receive their pay via direct deposit, they often get a receipt that outlines the deposit amount and any deductions. This document provides a quick reference, much like a pay stub.

- Payroll Summary Report: This document is generated by payroll systems and provides an overview of all employee wages, hours worked, and deductions for a specific period. It serves as a comprehensive summary akin to a pay stub.

- Expense Report: Employees submit this report to claim reimbursement for work-related expenses. While it focuses on expenses rather than income, it requires detailed breakdowns similar to those found on a pay stub.

- Commission Statement: For employees who earn commissions, this document outlines their earnings from sales, including any deductions. It parallels a pay stub by detailing earnings for a specific period.

- Salary Certificate: Often requested by employees for loan applications or other financial needs, this document certifies an employee's salary and may include deductions. Its purpose aligns with the pay stub in verifying income.

Each of these documents plays a crucial role in financial transparency and understanding, similar to the information provided in an ADP Pay Stub.

Common mistakes

Completing the ADP Pay Stub form can be straightforward, but many individuals make common mistakes that can lead to confusion or delays. One frequent error is providing incorrect personal information. This includes misspelling names or entering the wrong Social Security number. Such inaccuracies can cause issues with payroll processing.

Another mistake is neglecting to update information after a life change. For example, if someone changes their address or marital status, failing to reflect this on the pay stub can lead to complications in tax reporting and benefits. Keeping records current is essential for accurate payroll information.

Some individuals overlook the importance of verifying hours worked. If the hours entered are incorrect, it can result in underpayment or overpayment. Always double-check the hours before submission to ensure accuracy.

In addition, many people do not review the deductions listed on their pay stub. Understanding what is being deducted from paychecks is crucial. Errors in deductions can affect take-home pay and tax obligations. It is advisable to compare deductions with previous pay stubs for consistency.

Another common error is ignoring the importance of the pay period dates. Entering the wrong dates can lead to confusion regarding pay cycles. Pay periods must align with the actual work performed to ensure accurate compensation.

Failing to include necessary documentation can also pose a problem. Some forms may require additional paperwork or signatures. Not providing these can delay processing and payment.

People sometimes forget to account for overtime hours. If applicable, these hours should be clearly indicated on the form. Miscalculating overtime can lead to disputes regarding pay.

Another mistake is not keeping a copy of the submitted pay stub form. Retaining a copy is important for personal records and can be useful for future reference. It is advisable to have documentation in case any discrepancies arise.

Lastly, many individuals do not seek assistance when needed. If there is uncertainty about how to fill out the form correctly, reaching out for help can prevent mistakes. Utilizing available resources can lead to a smoother payroll process.