Fill a Valid Acord 130 Template

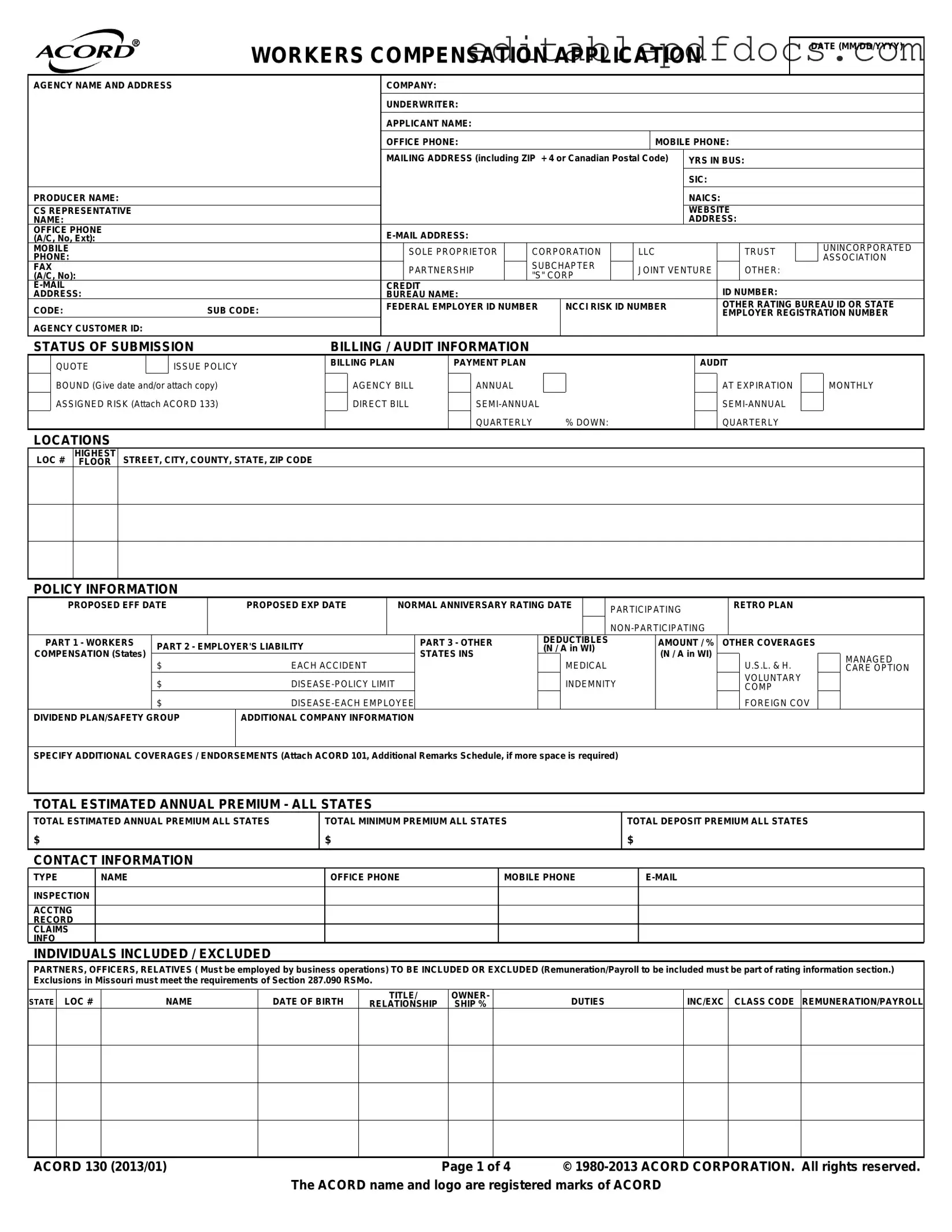

The ACORD 130 form serves as a crucial tool in the realm of workers' compensation insurance applications, streamlining the process for businesses seeking coverage. This comprehensive document collects essential information about the applicant, including their business structure, contact details, and operational history. Key sections of the form require applicants to disclose their years in business, the nature of their operations, and any relevant classifications such as the Standard Industrial Classification (SIC) and North American Industry Classification System (NAICS) codes. Additionally, the form captures vital data regarding employee details, such as remuneration and the number of employees, which are critical for calculating premiums. It also addresses potential risks by asking about past claims, safety protocols, and the use of subcontractors. The ACORD 130 not only facilitates the underwriting process but also ensures that insurers have a clear understanding of the applicant's risk profile, ultimately helping to determine appropriate coverage options and premium rates.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | The ACORD 130 form is used for applying for workers' compensation insurance. It collects essential information about the applicant's business and its operations. |

| Governing Laws | Each state has its own regulations governing workers' compensation. For example, in Missouri, exclusions must meet the requirements of Section 287.090 RSMo. |

| Information Required | The form requires detailed information such as the applicant's name, business structure, contact details, and years in business. |

| Premium Estimates | Applicants must provide estimated annual premiums for all states, including minimum and deposit premiums. |

| Employee Information | Details about employees, including their roles, classifications, and remuneration, are necessary for accurate rating and coverage. |

| Loss History | The form requests information about the applicant's loss history over the past five years, including claims and amounts paid. |

| Safety Programs | Applicants must disclose if a written safety program is in place, which can affect the underwriting process. |

| Fraud Warning | The form includes a warning about the consequences of providing false information, which can lead to severe penalties. |

| Signature Requirement | The application must be signed by an authorized representative of the applicant, ensuring the accuracy of the provided information. |

Dos and Don'ts

When filling out the ACORD 130 form, it’s essential to ensure accuracy and completeness. Here are some important dos and don’ts to keep in mind:

- Do provide accurate contact information, including phone numbers and email addresses.

- Do clearly indicate the type of business structure (e.g., corporation, LLC, partnership).

- Do include all necessary details regarding employees, including those to be included or excluded from coverage.

- Do review and double-check all entries for clarity and correctness before submission.

- Don't leave any sections blank; if a question does not apply, indicate that clearly.

- Don't provide misleading or incomplete information, as this can lead to legal issues.

- Don't forget to attach any necessary documents, such as loss runs or additional remarks schedules.

Following these guidelines can help streamline the application process and ensure that all necessary information is accurately captured. Attention to detail is key!

Documents used along the form

When applying for workers' compensation insurance using the Acord 130 form, several other documents often accompany it to provide a comprehensive view of the business's operations and risk profile. Each of these forms plays a crucial role in ensuring that the insurance provider has all the necessary information to assess the application accurately. Here’s a look at four commonly used forms and documents that complement the Acord 130.

- ACORD 133 - Workers Compensation Assigned Risk Plan Application: This form is used when a business is applying for coverage under the Assigned Risk Plan. It provides additional details about the company's operations and helps determine eligibility for this type of insurance.

- Hold Harmless Agreement: Incorporating a https://nyforms.com/hold-harmless-agreement-template into contracts can provide protection against third-party claims, ensuring all parties acknowledge their responsibilities and liabilities are clearly defined.

- ACORD 101 - Additional Remarks Schedule: This document allows applicants to provide extra information or comments that may not fit within the confines of the Acord 130. It’s particularly useful for detailing unique circumstances or additional coverage needs.

- Loss Runs: A loss run report summarizes a business's claims history over a specified period, typically the last five years. This document is vital for insurers to evaluate past claims and assess the risk associated with insuring the applicant.

- State Rating Worksheet: This worksheet collects detailed information about the business's operations, including classifications and payroll estimates. It helps in determining the appropriate rates for workers' compensation insurance based on state-specific regulations.

These forms and documents are essential in the workers' compensation application process. Together with the Acord 130, they help create a clearer picture of the business, ensuring that the insurance provider can offer the most accurate coverage options tailored to specific needs.

Popular PDF Forms

Cair Login - This record helps monitor any vaccine-related reactions over time.

To ensure a clear understanding of the expectations and obligations in a commercial rental scenario, it's important for both landlords and tenants to familiarize themselves with the specific terms involved in a Florida Commercial Lease Agreement. For detailed information on this essential legal document, you can read here.

Lien Waiver - Imposing strict adherence to this waiver format can help avert legal complications stemming from misunderstandings about payments due.

Gift Card Template - Whether it's for a birthday or a holiday, this gift certificate is a surefire way to delight someone special.

Similar forms

- ACORD 133 - Workers Compensation Additional Application: Similar to the Acord 130, this form is used to gather additional details about a business's workers' compensation needs. It complements the Acord 130 by providing further information on specific coverage requirements.

- ACORD 25 - Certificate of Liability Insurance: This document serves as proof of insurance coverage. Like the Acord 130, it includes essential information about the insured party, coverage limits, and the insurance provider, making it crucial for verifying compliance and risk management.

- ACORD 126 - Commercial General Liability Application: Both forms are used to assess insurance needs for businesses. While the Acord 130 focuses on workers' compensation, the Acord 126 addresses general liability, making them complementary in evaluating overall business risk.

- California Bill of Sale: This form is crucial for transferring personal property, ensuring that both the buyer and seller have clear documentation of the transaction. Utilizing resources like Fillable Forms can simplify the process and provide necessary templates for accuracy.

- ACORD 27 - Evidence of Property Insurance: This form provides evidence of property insurance coverage. Similar to the Acord 130, it details the insured property and coverage limits, serving as an essential tool for businesses to demonstrate their insurance status.

- ACORD 140 - Commercial Property Application: This application gathers details about a business's property insurance needs. Like the Acord 130, it collects critical information to help insurance providers assess risk and determine coverage options.

- ACORD 51 - Personal Auto Application: While this form pertains to personal auto insurance, it shares similarities with the Acord 130 in that both require detailed personal and vehicle information to evaluate risk and coverage needs.

- ACORD 1 - Application for Business Insurance: This comprehensive application captures a broad range of business insurance needs. Like the Acord 130, it aims to collect essential information that helps insurers tailor coverage to the specific risks faced by a business.

Common mistakes

Filling out the ACORD 130 form can be a daunting task, and mistakes can lead to delays or issues with your workers' compensation coverage. One common mistake is providing incomplete or inaccurate contact information. It's essential to ensure that all phone numbers, email addresses, and mailing addresses are correct. Missing or incorrect details can hinder communication with your insurance provider, causing unnecessary complications.

Another frequent error is neglecting to specify the nature of your business operations. The form requires a detailed description of what your business does, including the types of products or services offered. Failing to provide this information can result in misclassification, which may affect your premiums and coverage options. Be thorough and clear when describing your operations to avoid potential issues.

People often overlook the importance of accurately reporting employee information. This includes the number of employees, their classifications, and their estimated annual remuneration. Incorrect figures can lead to miscalculations in your premium, which could result in underinsurance or overpayment. Take the time to gather this information accurately to ensure that your coverage aligns with your actual business operations.

Additionally, some applicants forget to include all relevant exclusions and inclusions for employees. The form has specific sections to list individuals who are included or excluded from coverage, such as partners, officers, or relatives. Omitting this information can lead to gaps in coverage or unexpected liabilities. Be diligent in specifying who is covered under your policy.

Another mistake involves not reviewing the loss history and prior carrier information. This section requires you to provide details about any claims made in the past five years. Failing to disclose this information can raise red flags for insurers and may result in higher premiums or denial of coverage. Always be transparent about your claims history.

Lastly, some applicants rush through the signature section or forget to sign altogether. This final step is crucial as it confirms that the information provided is accurate and complete to the best of your knowledge. A missing signature can delay the processing of your application or even invalidate it. Always double-check that you have signed and dated the form before submission.