Fill a Valid 14653 Template

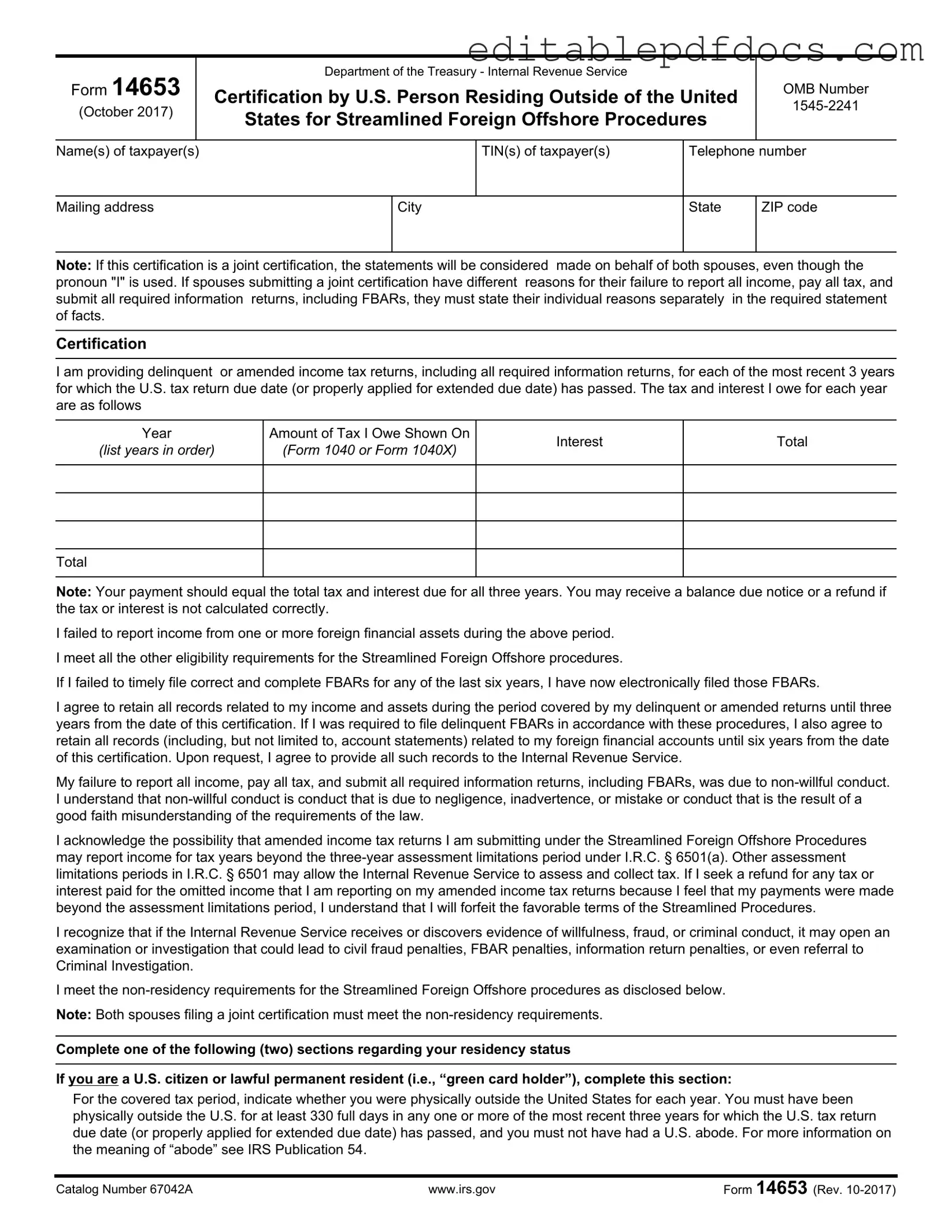

The IRS Form 14653 serves a critical role for U.S. citizens and lawful permanent residents living outside the United States who wish to participate in the Streamlined Foreign Offshore Procedures. This form allows individuals to certify their eligibility for these procedures, which are designed to help taxpayers who have failed to report foreign income or assets due to non-willful conduct. The form requires taxpayers to provide detailed information, including their tax identification numbers, contact information, and a comprehensive statement explaining the reasons for their past non-compliance. Taxpayers must also submit delinquent or amended income tax returns for the previous three years, along with any required information returns, such as Foreign Bank Account Reports (FBARs). Additionally, the form emphasizes the importance of maintaining records related to foreign financial accounts for specific periods. It is essential for filers to understand that any discrepancies or incomplete submissions could jeopardize their eligibility for the streamlined procedures. The form also highlights the necessity of disclosing specific facts about foreign income, assets, and the circumstances surrounding any failures to report, ensuring that the IRS can accurately assess each taxpayer’s situation. By completing Form 14653, individuals take a significant step toward rectifying their tax status while benefiting from the protections offered under the streamlined procedures.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | Form 14653 is used by U.S. persons residing outside the United States to certify their eligibility for the Streamlined Foreign Offshore Procedures. |

| Governing Law | This form is governed by the Internal Revenue Code (I.R.C.), specifically sections related to tax compliance and reporting for U.S. citizens and residents. |

| Eligibility Requirements | To qualify, individuals must meet specific criteria, including having failed to report foreign income due to non-willful conduct. |

| Joint Certification | If filing jointly, both spouses must meet the non-residency requirements and provide separate reasons for any discrepancies in reporting. |

| Record Retention | Taxpayers must retain records related to their income and foreign financial accounts for three to six years, depending on the type of documentation. |

| Potential Penalties | Failure to comply with the requirements may lead to civil fraud penalties or criminal investigations if willful conduct is suspected. |

| Submission Completeness | All submissions must include a narrative statement of facts explaining the reasons for the failure to report income; incomplete submissions will not qualify for relief. |

Dos and Don'ts

When filling out Form 14653, it is crucial to approach the process with care. The following list outlines key actions to take and avoid to ensure a smooth submission.

- Do provide accurate and complete information for all required fields, including your name, TIN, and contact details.

- Do clearly explain your reasons for failing to report income and submit required returns. Include both favorable and unfavorable facts.

- Do retain all relevant records related to your income and foreign financial accounts for the specified retention periods.

- Do ensure that both spouses meet the non-residency requirements if submitting a joint certification.

- Do review your submission thoroughly before sending it to avoid errors that could delay processing.

- Don't leave any sections blank. Incomplete submissions may be rejected or delayed.

- Don't provide vague explanations. Specific details about your financial situation and the sources of your foreign assets are essential.

- Don't forget to attach necessary documents, such as computations for the substantial presence test if applicable.

- Don't misrepresent any information. Providing false information can lead to severe penalties.

- Don't assume that the IRS will contact you for missing information. It is your responsibility to ensure everything is included.

Documents used along the form

The Form 14653 is used by U.S. persons living outside the United States to certify their eligibility for the Streamlined Foreign Offshore Procedures. When completing this form, there are several other documents that may be required or helpful to include in the submission. Below is a list of these forms and documents, along with brief descriptions of each.

- Form 1040: This is the U.S. Individual Income Tax Return. Taxpayers use this form to report their income, claim tax deductions and credits, and calculate their tax liability. For those participating in the Streamlined Procedures, amended returns for the past three years are typically required.

- Chick-fil-A Job Application form: To apply for a position at Chick-fil-A, prospective employees can utilize the Fillable Forms that streamline the application process and gather necessary personal and work history information.

- Form 1040X: This form is the Amended U.S. Individual Income Tax Return. Taxpayers use it to make corrections to a previously filed Form 1040. If there are errors or omissions in the original returns, this form is necessary to rectify those issues.

- FBAR (FinCEN Form 114): The Foreign Bank Account Report is required for U.S. persons who have financial interests in or signature authority over foreign financial accounts exceeding certain thresholds. Submitting this form is essential for compliance with U.S. laws regarding foreign assets.

- Statement of Facts: This is a narrative document where the taxpayer explains the reasons for their failure to report all income and file required returns. It should include personal and financial background information and any relevant circumstances that contributed to the oversight.

Including these additional forms and documents can help ensure a complete and accurate submission under the Streamlined Foreign Offshore Procedures. Each document plays a crucial role in demonstrating compliance and providing the necessary context for the taxpayer's situation.

Popular PDF Forms

Flying Internationally With Dog - Understand the travel regulations for both domestic and international flights.

By utilizing resources such as topformsonline.com, LLCs can better understand the nuances of an Operating Agreement and ensure they are set up for success with a clear framework that promotes healthy collaboration among members.

Uscis I-134 - The I-134 can be submitted electronically or via paper, depending on the situation.

Indiana Odometer Statement - Complete and accurate odometer statements may help speed up registration processes.

Similar forms

Form 1040: This is the standard individual income tax return form used by U.S. citizens and residents to report their income, claim deductions, and calculate their tax liability. Like Form 14653, it requires detailed information about income and tax owed.

Form 1040X: This form is used to amend a previously filed tax return. It serves a similar purpose to Form 14653 in that it addresses corrections or omissions in prior filings.

New York DTF-84: This form is vital for accessing state tax records in New York, allowing authorized parties to obtain crucial documents for various reasons like legal or financial matters. For further details, visit https://nyforms.com/new-york-dtf-84-template.

FBAR (FinCEN Form 114): This form is required to report foreign bank accounts and financial assets. Both the FBAR and Form 14653 deal with foreign financial assets and compliance with U.S. tax laws.

Form 8938: This form is used to report specified foreign financial assets. Like Form 14653, it is part of the effort to ensure U.S. taxpayers disclose their foreign holdings.

Form 5471: This form is for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. It shares similarities with Form 14653 in that it requires detailed reporting of foreign financial interests.

Form 8865: This form is used to report information about foreign partnerships. Like Form 14653, it addresses the reporting of foreign entities and compliance with tax obligations.

Form 3520: This form is used to report transactions with foreign trusts and the receipt of certain foreign gifts. Both forms emphasize the importance of reporting foreign financial interests accurately.

Form 3520-A: This form is required for foreign trusts with U.S. owners. Similar to Form 14653, it involves reporting foreign financial activities and ensuring compliance with U.S. tax laws.

Form 1116: This form is used to claim a foreign tax credit. Like Form 14653, it deals with foreign income and taxes, helping taxpayers avoid double taxation.

Form 8833: This form is used to disclose a treaty-based return position. It shares the theme of compliance and reporting foreign financial matters, similar to the objectives of Form 14653.

Common mistakes

When completing Form 14653, individuals often make several common mistakes that can affect the processing of their submission. One frequent error is failing to provide complete taxpayer information. Each taxpayer must include their name, Tax Identification Number (TIN), and contact details. Incomplete or incorrect information can lead to delays or rejections of the form.

Another mistake involves not disclosing all required facts about income and foreign financial accounts. The form requires a detailed statement explaining any failures to report income or submit necessary information returns. If this narrative is missing or lacks sufficient detail, the submission may be deemed incomplete, which could disqualify the applicant from the Streamlined Foreign Offshore Procedures.

Many individuals also overlook the importance of providing specific residency information. For U.S. citizens and lawful permanent residents, it is crucial to confirm whether they were physically outside the United States for at least 330 days during the relevant tax years. Not answering this question accurately can result in an invalid submission.

Additionally, failing to calculate tax and interest owed correctly is a significant error. The total amount due must be clearly listed for each tax year. If the figures do not match the attached returns or are inaccurately calculated, this discrepancy can lead to further complications with the IRS.

Some applicants neglect to include their reasons for failing to report income. The form requires individuals to explain their non-willful conduct. Without a clear explanation of the circumstances, including any reliance on professional advice, the IRS may not grant the requested relief.

Joint filers often make the mistake of not coordinating their statements. If spouses have different reasons for their failures, they must provide individual explanations. Failing to do so can result in confusion and may hinder the approval of the joint certification.

Another common issue is not retaining the required records. Taxpayers must keep all relevant documentation for three years from the date of certification. If the IRS requests these records and they are not available, it may lead to penalties or further investigations.

Moreover, some individuals do not realize the implications of reporting income beyond the three-year assessment limitations period. Those seeking refunds for such income may lose the benefits of the Streamlined Procedures. Understanding these limitations is essential to avoid unexpected consequences.

Finally, failing to sign the form correctly is a simple yet critical mistake. Each taxpayer must sign and date the form, and if it is a joint certification, both spouses must provide their signatures. Omitting a signature can result in the form being considered invalid, delaying the entire process.